The Inflation Fight Begins: March 2022 Markets

As expected, the Federal Reserve hiked interest rates in March for the first time since 2018.[1] Inflationary pressures, bond market recession indicators, and Fed tightening have started chipping away at a strong economic backdrop. Nevertheless, U.S. stock markets staged a recovery to end a rough quarter.

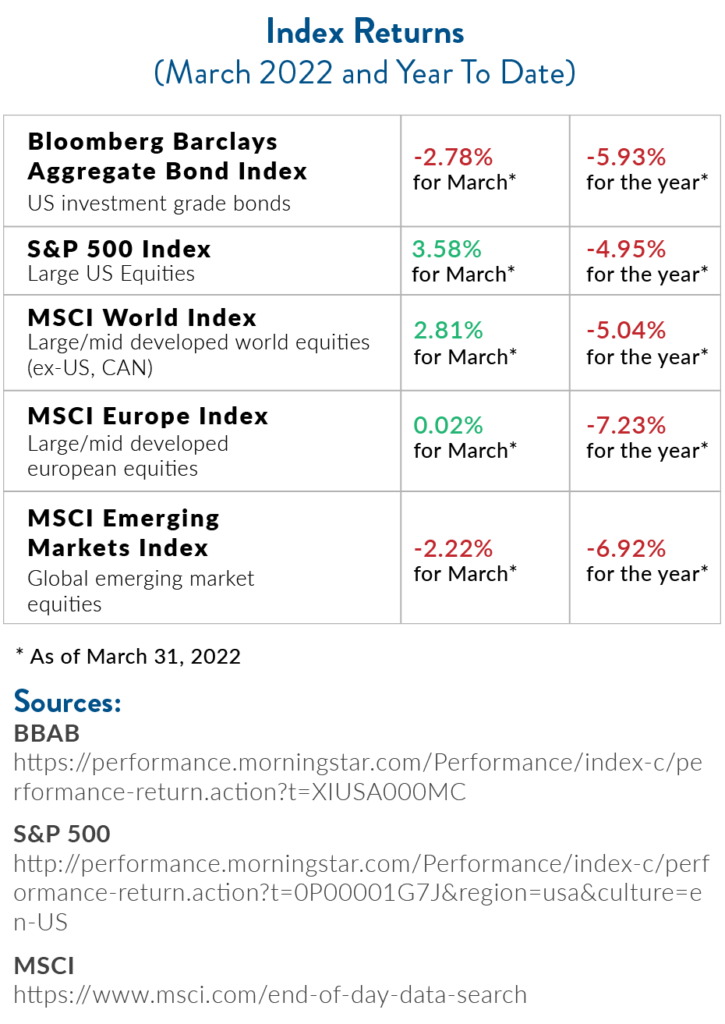

Despite being besieged by geopolitical tensions and stagflation talk, stock markets staged a recovery in the second half of March. The S&P 500 marked its largest 15-day percentage gain since June 2020, up 11% between March 8 and March 30.[2] However, both equity and bond markets finished off the first quarter of the year with negative returns, with the S&P 500 losing 4.95%. Commodities were one of the few safe havens.[3]

Despite being besieged by geopolitical tensions and stagflation talk, stock markets staged a recovery in the second half of March. The S&P 500 marked its largest 15-day percentage gain since June 2020, up 11% between March 8 and March 30.[2] However, both equity and bond markets finished off the first quarter of the year with negative returns, with the S&P 500 losing 4.95%. Commodities were one of the few safe havens.[3]

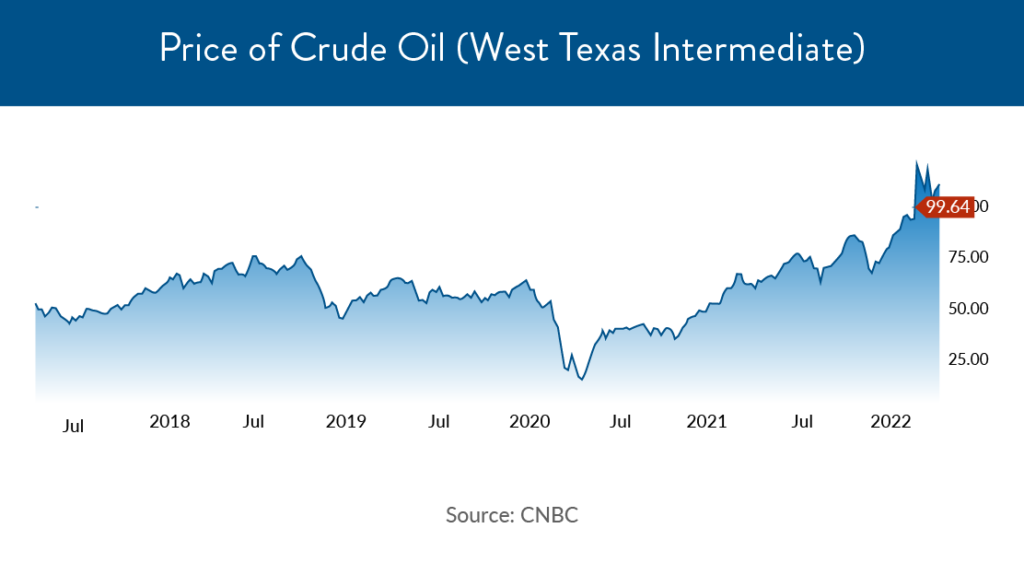

A reprieve for oil

A reprieve for oil

Given the ongoing Russia-Ukraine crisis, oil has been a focal point this month, with prices reaching new highs at over $120 a barrel in March.[4]

In response, the Biden administration announced a plan to release nearly one million barrels of oil per day from U.S. strategic reserves in a move to address rising gasoline prices and supply problems. The entire amount of oil released might be 180 million barrels.[5]

Striking a Delicate Balance

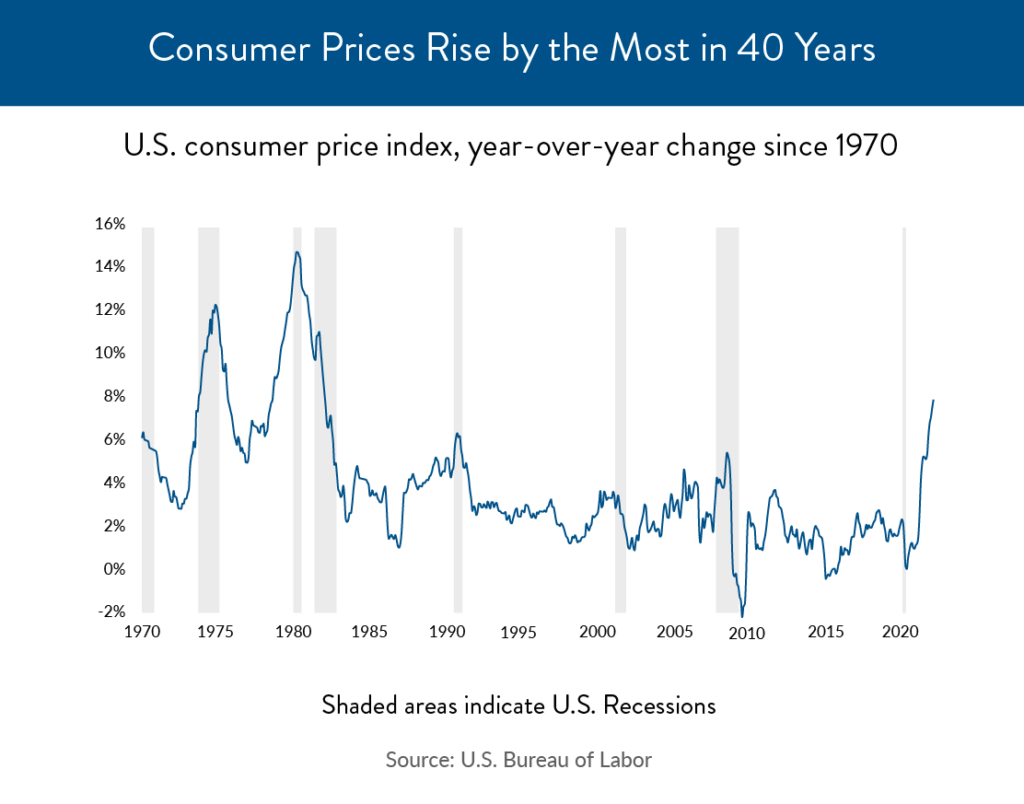

We do not need much more than a trip to the grocery store or to a gas station to remind us that inflation has been a headline-grabbing topic more broadly.

The Fed was already facing the tricky challenge of normalizing interest rates and managing inflation through COVID-19 impacted supply constraints, when the Russia-Ukraine war complicated matters. Russia and Ukraine are leading exporters of energy, raw materials, food, and fertilizer, meaning that the war could continue to spike prices amid already tight supply chains.[6] Headline inflation has soared at rates not seen in nearly four decades.[7]

The Fed Challenge

To fight back against soaring inflation, the Fed bumped interest rates up 0.25% for the first time since 2018.[8] It’s likely the rate hikes won’t slow down anytime soon. The Fed expects seven total rate hikes within the next nine months, and we might see federal funds rates between 1.75% and 2% by the end of the year and 2.8% by the end of 2023.[9] An era of extremely low interest rates is starting to reverse.

With the Fed’s options, they may have no choice but to hike rates by 0.50% at some of their upcoming meetings. Goldman Sachs believes this could happen in both May and June.[10]

A Recession Debate

Both inflation and the Fed’s hawkish moves could impact growth; indeed, the Fed has raised its inflation projections and lowered growth forecasts.[11] Goldman Sachs slashed its gross domestic product forecast, which measures economic growth, and warned that the chance of a recession in the U.S. within the next year may be as high as 35%.[12]

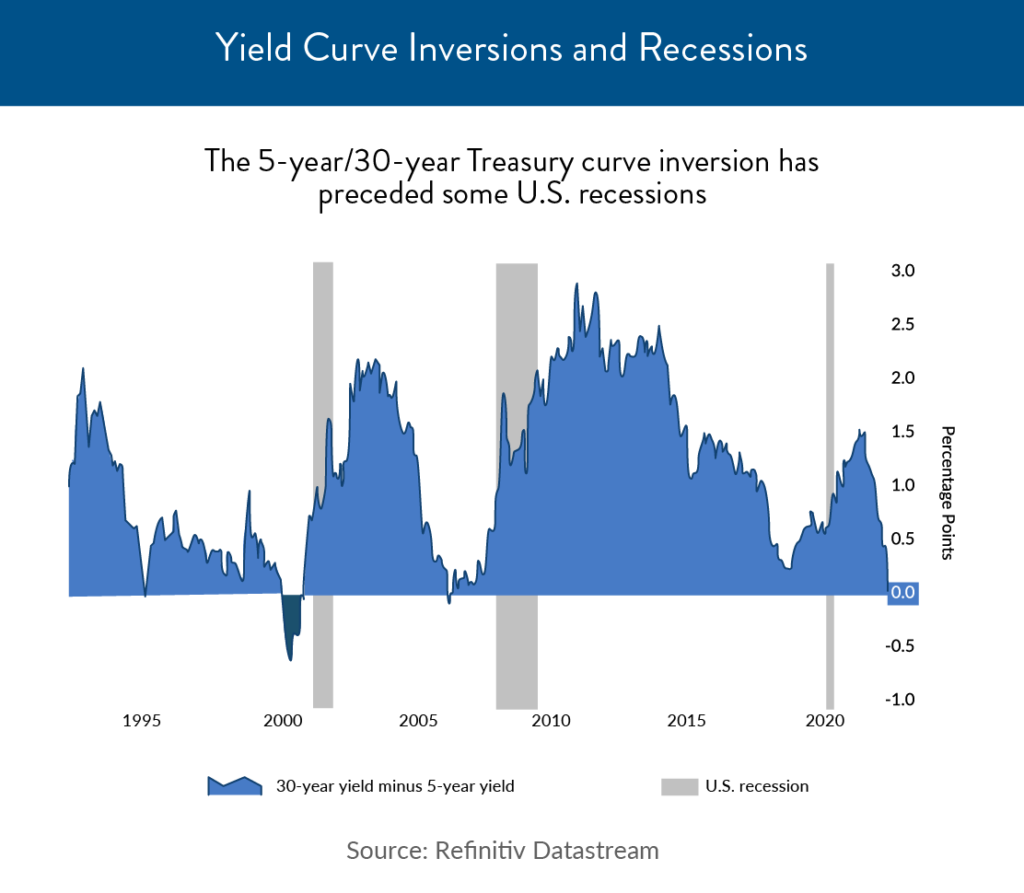

The bond market is flashing some warning signs. On Tuesday, March 29, the 2-year and the 10-year yield curve, which shows the difference between 2-year and 10-year rates, officially inverted for the first time since September 2019.[13]

This data point is often confusing, so a quick explanation is in order: it means that short-term interest rates are exceeding longer-term rates. The bond market is basically saying that it expects long term interest rates to fall in the future—generally associated with recessions.

Such an inverted yield curve has predicted nearly every recession over the past 60 years.[14] However, this indicator isn’t perfect.[15]

Some experts are also pushing back against recession talk. A recent report from Federal Reserve economists challenged the validity of this phenomenon as a recession indicator.[16] The report argues that the current inversion, if anything, should indicate easing inflation expectations that permit monetary tightening.

Erin Browne, fund manager at Pacific Investment Management Co. (PIMCO), has similarly downplayed the signal, citing the influence of massive quantitative easing as a source of interest rate movements.[17]

Of course, only time will tell whether the economy will drop into a recession, especially given the influence of so many other factors, including the horrific Russia invasion of Ukraine. Either way, recessions typically lag yield curve inversions, and strong market performance could still continue in the meantime.[18]

Even with growing economic concerns, U.S. consumer confidence unexpectedly rose in March,[19] suggesting that solid job growth has offset concerns about inflationary risks to spending and growth. Moreover, thanks to the recovery in stock prices and housing values, household net worth in the United States hit a new high in the fourth quarter of 2021, reaching $150 trillion.[20] It’s important to remember that consumers seem to have cash reserves to weather any economic shocks.

Looking Ahead

Lastly, the war in Ukraine and the civilian tragedies it has caused remain a source of heartbreak and uncertainty. While the Russians claim they are cutting back operations surrounding Kyiv to build trust for peace talks, many doubt their real intentions.[21] The way things stand now, there seems to be a war of attrition and the makings of a potential protracted battle.

Along with the other economic and market factors at play, we could see some volatility in the months ahead.

Your concerns are our concerns, and as always, we are here to help. Please contact us if your financial situation has changed or if you have any questions or wish to review your plans for the rest of the year. In the meantime, we are wishing you a happy spring!

Click to download print version of this article.

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase,sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Europe Index captures large and mid-cap representation across 15 developed markets countries in Europe and covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP is the most commonly used measure of economic activity.

An inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. This type of yield curve is the rarest of the three main curve types and is considered to be a predictor of economic recession. Historically, inversions of the yield curve have preceded many of the U.S. recessions. Due to this historical correlation, the yield curve is often seen as an accurate forecast of the turning points of the business cycle. A recent example is when the U.S. Treasury yield curve inverted in late 2005, 2006, and again in 2007 before U.S. equity markets collapsed. The curve also inverted in late 2018. An inverse yield curve predicts lower interest rates in the future as longer-term bonds are demanded, sending the yields down.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

Sources:

[1] https://www.bloomberg.com/news/articles/2022-03-16/fed-lifts-rates-a-quarter-point-in-opening-bid-to-curb-inflation

[2] https://www.reuters.com/business/mystifying-us-stock-rally-defies-economic-unease-2022-03-30/

[3] https://www.bloomberg.com/news/articles/2022-03-31/losing-5-was-best-you-could-do-in-stocks-and-bonds-this-quarter

[4] https://www.cnbc.com/quotes/@CL.1

[5] https://www.bloomberg.com/news/articles/2022-03-31/what-a-sizable-u-s-oil-release-may-mean-for-energy-markets

[6] https://www.washingtonpost.com/politics/2022/03/02/russia-ukraine-are-key-exporters-food-energy-will-global-prices-spike/

[7] https://finance.yahoo.com/news/consumer-price-index-cpi-inflation-february-2022-203614415.html?fr=yhssrp_catchall

[8] https://www.reuters.com/world/us/all-systems-go-feds-liftoff-us-interest-rates-2022-03-16/

[9] https://www.reuters.com/world/us/all-systems-go-feds-liftoff-us-interest-rates-2022-03-16/

[10] https://finance.yahoo.com/news/goldman-sachs-now-expects-fed-105834994.html?fr=yhssrp_catchall

[11] https://www.axios.com/fed-rate-increase-698953fc-84a0-401c-ab40-9d95adcea51d.html

[12] https://www.bloomberg.com/news/articles/2022-03-11/goldman-sachs-cuts-u-s-growth-forecasts-on-hit-from-oil-war

[13] https://www.reuters.com/business/mystifying-us-stock-rally-defies-economic-unease-2022-03-30/

[14]https://www.cnn.com/2022/03/26/economy/inverted-yield-curve-march-warning/index.html

[15] https://www.reuters.com/business/finance/part-us-yield-curve-just-inverted-does-that-mean-recession-is-coming-2022-03-28/

[16] https://www.federalreserve.gov/econres/notes/feds-notes/dont-fear-the-yield-curve-reprise-20220325.htm

[17] https://www.bloomberg.com/news/articles/2022-03-30/pimco-says-curve-inversion-may-be-unreliable-recession-signal

[18] https://www.yahoo.com/video/1-u-5-30-yield-081651655.html

[19] https://www.aljazeera.com/economy/2022/3/29/us-consumer-confidence-edges-up-in-march-despite-inflation

[20] https://www.bloomberg.com/news/articles/2022-03-10/u-s-household-net-worth-jumps-to-a-record-on-equities-housing

[21] https://abcnews.go.com/International/wireStory/russias-military-claims-fundamentally-cut-back-operations-kyiv-83738140

Performance table sources:

BBAB: https://performance.morningstar.com/Performance/index-c/performance-return.action?t=XIUSA000MC