Display results

21 April

Markets Stay Upbeat Despite Banking Turmoil

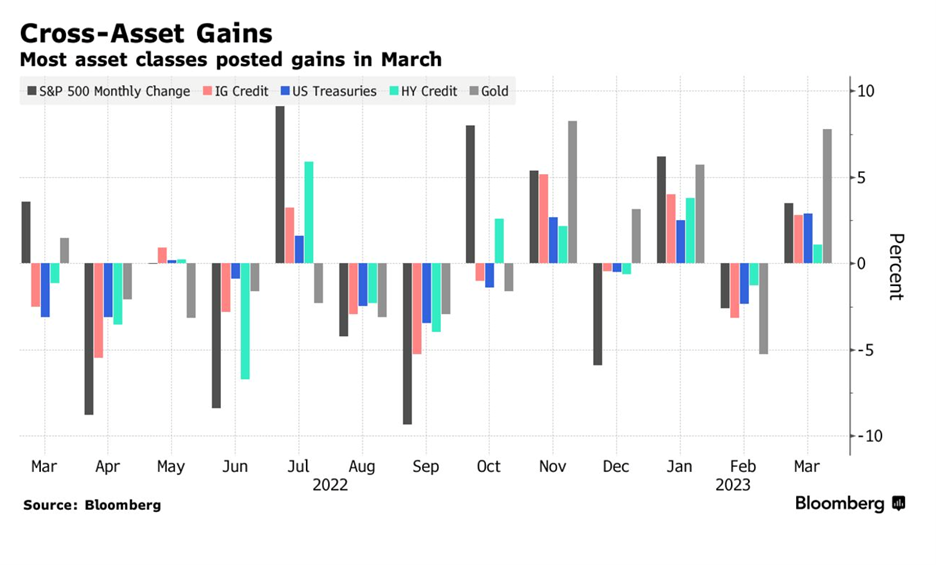

Markets weathered banking uncertainty in March remarkably well – bonds and stocks both rose, gold soared on rate-cut bets, and credit traders showed confidence in company balance sheets.[2]

Source: https://www.bloomberg.com/news/articles/2023-04-06/mixed-up-markets-can-t-get-story-straight-as-bank-drama-smolders?cmpid=BBD040623_BIZ&utm_medium=email&utm_source=newsletter&utm_term=230406&utm_campaign=bloombergdaily

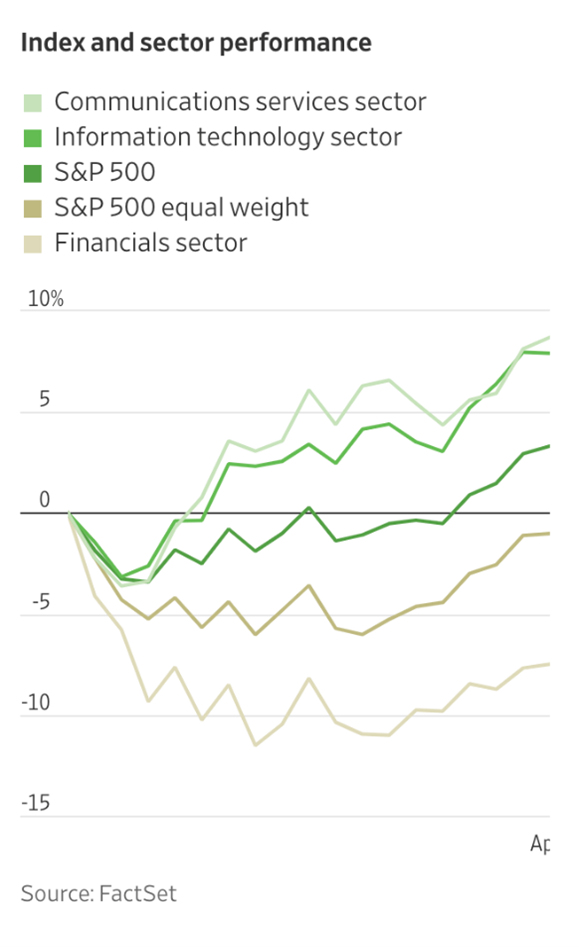

Both the S&P 500 (+3.51%) and Nasdaq (+6.69%) equity indices edged higher in March, with technology stocks counteracting a selloff in the financial sector.[3],[4] The tech-focused Nasdaq had its best quarter since 2020, up 16.77%.[5] Tech stocks have benefited from a tailwind driven by hopes that the Federal Reserve (Fed) is close to pausing its aggressive interest-rate hike campaign. Given expectations of lower rates, bond yields have tumbled (leading to higher bond prices).[6]

Source: https://www.wsj.com/articles/s-p-500s-resilience-in-the-banking-crisis-is-largely-thanks-to-tech-654cc621?mod=markets_lead_pos1

A Casualty of Higher Interest Rates

The first few weeks of March were dominated by concerns over the banking system sparked by Silicon Valley Bank(SVB), which primarily serviced startups and venture capital investors.[7]

Low interest rates had driven an influx of deposits at SVB, but as the Fed hiked rates and liquidity dried up, depositors began asking for more withdrawals.[8] A shortfall of available cash liquidity led to a classic bank run, where depositors demanded more withdrawals than available capital.

Liquidity concerns spilled over to lower confidence in smaller regional banks like Signature Bank. SVB and Signature eventually became two of the three biggest banking failures in US history.[9] Separately, Silvergate Bank also shut operations after suffering losses from cryptocurrency industry exposure.[10]

Regulators took control of the failed banks, guaranteed all deposits, and are still closely monitoring the banking sector.[11] As concerns spread to Europe, Swiss regulators engineered a takeover of Credit Suisse by UBS to restore trust in the banking system.[12]

Banking Postmortem

After a crisis, the most pressing question is – is the crisis contained, and will it happen again? A few aspects of the bank failures stand out:

Liquidity mismanagement

Most banks operate with an asset–liability mismatch, where they take in deposits that can be requested immediately, but they make longer-term loans or investments that expire over lengthier periods. SVB had a massive share of its assets invested in long-term fixed-income securities that dropped heavily in value as the Fed hiked rates.[13] When yields go up, bond prices go down.

If they had been able to hold these securities to maturity, they would not have suffered a loss. However, to meet depositor withdrawals, SVB had to sell a $21 billion portfolio at a loss of $1.8 billion while announcing they needed $2 billion in new capital.[14] This announcement spooked investors and cascaded into a bank run where the bank was unable to meet all the withdrawal requests.

Depending on a large long-term government bond portfolio for liquidity during a rising interest rate cycle was questionable – a top regulator at the Fed blamed bank officials for the collapse, calling SVB a case of poor management.”[15]

Regulatory controls

The obvious question is – weren’t regulations strengthened and more capital requirements put in place after the 2008 financial crisis?

SVB and banks its size are not subject to the stricter regulatory standards that the nation’s biggest banks must follow. In 2018, lawmakers passed a bill that relaxes regulations for many regional financial institutions, including rules regarding the cash reserves required to guard against shocks.

The nation’s largest banks also have to meet stipulations about how diversified their businesses need to be, which turned out to be an Achilles heel for the startup focused SVB.[16] The “Twitter-led bank run” was exacerbated by venture capitalist investors who told their companies to move money out of SVB.[17] Critics are calling for more speed and transparency in US bank supervision, and we wouldn’t be surprised to see more future regulation.[18]

Deposits

Another critical difference between SVB and much of the banking system is the level of uninsured deposits. The Federal Deposit Insurance Corp (FDIC) protects insurer deposits up to $250,000, but over 94% of SVB deposits were uninsured at the end of 2022 (as were 93% of Signature Bank deposits).[19] Banks where more deposits are covered under FDIC limits are relatively immune to a bank run. At most banks, around half of deposits are uninsured.[20]

After the failures of SVB and Signature Bank, the government’s decision to guarantee all deposits– including uninsured deposits — should help reduce the chances of further bank runs because of liquidity shortfalls.[21] Please view the attached brochure about the safety and protections of your accounts at Fidelity Investments and NFS.

Source: https://www.linkedin.com/pulse/markets-respond-svb-failure-whats-happening-what-mona-mahajan/?trackingId=m%2Bw%2FufD8SUCPO7Nxac6gtw%3D%3D

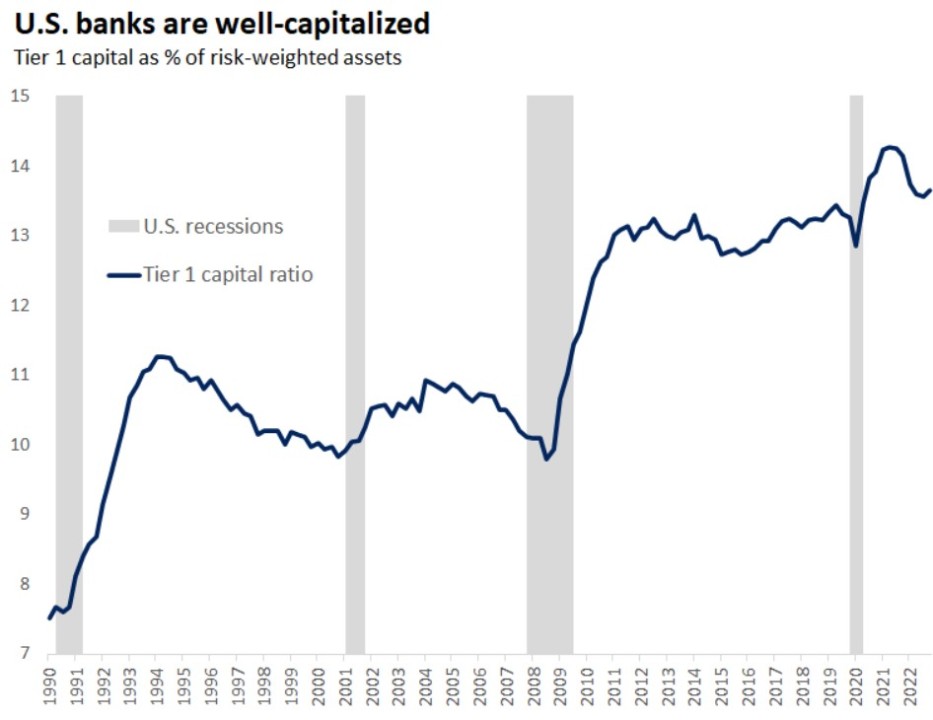

Given the swift measures taken by regulators, the turmoil in the banking system appears to have had limited impact on US consumers.[22] The big picture view is that US banks are far better capitalized now than during previous crises.

The Fed Adjusts

Meanwhile, the crisis has impacted the course of Fed policy.

Even though earlier in the month, Fed chair Jerome Powell indicated that rates might rise above 5.25%, they abandoned those plans at the FOMC meeting Mar 21-22 and left the target range for the federal funds rate unchanged from the December projections, topping out between 5-5.25%.[23] Any tightening in credit conditions from banks can serve as a substitute for rate hikes.

However, following persistent signs of economic growth and inflation, the Fed decided to raise interest rates another quarter point to demonstrate its commitment to fighting inflation.[24],[25] They are now signaling just one more hike this year in the second quarter, but less easing next year than previously projected.[26]

Looking Ahead

Traders are once again at odds with Fed projections, expecting the Fed to start cutting rates again this year.[27] The shifts in market expectations reflect the impossibility of predicting the exact path of the economy, inflation, and interest rates.

Keep in mind that the uncertainty in markets is just another instance of the unpredictability we’ve seen in our many decades of money management. The prudent approach remains the same: creating a diversified and sustainable strategy that matches your objectives while maintaining discipline to weather volatile markets. We welcome any questions about your portfolio, markets, and the economy – always happy to hear from you!

Your friends at JSF

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase, sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

Dollar Cost Averaging-Dollar-cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period of time, regardless of price.

FDIC – https://www.fdic.gov/

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] https://www.bloomberg.com/news/articles/2023-04-06/mixed-up-markets-can-t-get-story-straight-as-bank-drama-smolders

[2] https://www.bloomberg.com/news/articles/2023-04-06/mixed-up-markets-can-t-get-story-straight-as-bank-drama-smolders

[3] https://www.cnbc.com/2023/03/30/stock-market-today-live-updates.html

[4] https://www.ft.com/content/220d02d5-0389-4fbe-8e4c-30ba31d41619

[5] https://www.cnbc.com/2023/03/30/stock-market-today-live-updates.html

[6] https://www.wsj.com/articles/s-p-500s-resilience-in-the-banking-crisis-is-largely-thanks-to-tech-654cc621

[7] https://www.wsj.com/articles/bank-collapse-crisis-timeline-724f6458

[8] https://www.wsj.com/articles/bank-collapse-crisis-timeline-724f6458

[9] https://www.pbs.org/newshour/economy/why-silicon-valley-bank-and-signature-bank-failed-so-fast

[10] https://www.nytimes.com/2023/03/10/business/silicon-valley-bank-stock.html

[11] https://apnews.com/article/yellen-bank-collapse-silicon-valley-first-republic-6f5537524e1883c04e9488bae83a0345

[12] https://www.wsj.com/articles/bank-collapse-crisis-timeline-724f6458

[13] https://www.pbs.org/newshour/economy/why-silicon-valley-bank-and-signature-bank-failed-so-fast

[14] https://www.pbs.org/newshour/economy/why-silicon-valley-bank-and-signature-bank-failed-so-fast

[15] https://www.nytimes.com/2023/03/28/business/economy/svb-banks-fed-hearing.html

[16] https://www.nytimes.com/interactive/2023/03/10/business/bank-failures-silicon-valley-collapse.html

[17] https://www.cnbc.com/2023/03/10/silicon-valley-investors-and-founders-express-shock-at-svb-collapse.html

[18] https://www.reuters.com/business/finance/us-bank-supervision-needs-more-speed-transparency-wake-svb-debacle-critics-say-2023-03-30/

[19] https://www.spglobal.com/marketintelligence/en/news-insights/blog/bank-failures-the-importance-of-liquidity-and-funding-data

[20] https://www.spglobal.com/marketintelligence/en/news-insights/blog/bank-failures-the-importance-of-liquidity-and-funding-data

[21]https://www.pbs.org/newshour/economy/why-silicon-valley-bank-and-signature-bank-failed-so-fast

[22] https://www.reuters.com/markets/us/us-consumer-mood-darkens-banking-turmoil-impact-limited-so-far-umich-says-2023-03-31/

[23] https://www.wsj.com/articles/fed-walks-tightrope-between-inflation-and-financial-instabilitybut-for-how-long-789283d0

[24] https://www.wsj.com/articles/fed-walks-tightrope-between-inflation-and-financial-instabilitybut-for-how-long-789283d0

[25] https://www.wsj.com/articles/latest-fed-decision-to-raise-rates-came-down-to-the-wire-that-was-a-rough-weekend-b70fa204?mod=hp_lead_pos2

[26] https://www.reuters.com/markets/rates-bonds/feds-collins-leans-toward-one-more-rate-hike-then-hold-rest-year-2023-03-30/

[27] https://www.wsj.com/articles/investors-seek-safety-in-tech-stocks-money-market-funds-a303816f?mod=markets_lead_pos5

Read more

4 April

A Letter from Our Founder: Q1 Takeaways and Opportunities

As we turn our calendars to the second quarter, it’s a great time to take a step back and reflect on the expected and unexpected events of Q1 2023.

Alongside unprecedented rain and snowfall throughout Los Angeles and southern California, the markets also faced continued volatility as the quarter marked increased pressure from the Federal Reserve (Fed) and ongoing collapse throughout the banking sector. However, I’ve always stood by the mantra, “every calamity presents an opportunity” – and events in the first months of 2023 no doubt fall into both categories. Let’s explore what we are up against and where we turn our focus moving forward as we enter a new quarter.

More Uncertainty in the New Year

We are all still recovering from 2022, which was one of the most challenging years we have witnessed in our 26 plus year firm history. While we have experienced broader and more violent declines in the equity markets, we have not simultaneously experienced such a significant pull back in the fixed income markets, which have historically been a safe haven in difficult economic periods.

We have now experienced four significant stock market pullbacks with our clients over the past 26 years. The first one was the bursting of the tech bubble and the horrific 9/11 attack which led the markets downwards from 2000-2003; the second was the financial crisis where many major banks and financial institutions melted down and collapsed from 2007-2009; the next was the sharp downturn in the first quarter of 2020 from the Covid pandemic and most recent was the broad markets and asset sell off in 2022 in response to far greater inflation than anticipated leading to a record number of interest rate hikes by the Federal Reserve.

The Continued Fed Impact and Implosion of the Banking Sector

One of the oldest sayings in the financial world is “You can’t fight the Fed.” The Fed has the broad ability to impact and influence the direction of the financial markets, as we saw last December through raising their Fed funds rate half a percentage point to 4.50%.[1] As inflation moved from transitory to a real issue requiring policy changes, we experienced what may have been the worst year in history for the bond markets. Arguably, the bump up in the markets in January were mostly predicated on the Federal Reserve changing its policy from hiking rates to neutral or possibly even to lowering rates by the end of this year due to softness in the overall economy.

However, the Fed in Q1 increased interest rates twice more, and the Federal funds benchmark borrowing rate is now in a 4.75-5% target range.[2] We have been debating the hidden and unpredictable impact of the almost unprecedented Fed increase in the past year. It’s now obvious to all that while the Fed has been focused on bringing down inflation, their actions also may have led to a mini financial crisis in March, when we saw three major banks implode in only days. Other regional banks continue to trade as if they’re in deep distress and possibly also facing impending takeovers. While all depositor funds are seemingly safe due to the U.S. Treasury’s actions protecting depositors, we still saw panic in the banking system like we haven’t witnessed since 2008.

One likely impact is that future bank lending will slow down considerably, and the likelihood of a future recession has increased significantly. We have also seen a flight to quality in the U.S. government bond market as investors crave the safety of U.S. Bonds and have moved funds to institutions they deem safer.

JSF Client Account Assurance

In 2008, we at JSF decided to maintain the custody of our client funds at Fidelity and National Financial Services. These firms do not provide direct investment banking services. Because they have no banking arm, the companies have no exposure to banks – which we have seen with recent events could breach capital requirements or make ill-conceived investments that end up declining steeply in value. Fidelity states it does not utilize proprietary trading strategies and only executes trades at the client direction.[3] Please view this brochure about the safety and protections of your accounts at Fidelity Investments and NFS.

What’s Emerging on the Q2 Horizon?

While it’s impossible to know when the market bottoms, the market pendulum tends to swing too far in either direction ending in fear and capitulation. Hindsight and experience teach us though that not only is it imperative to stay invested through the market volatility but those rewarded most are the ones who have the courage to remain invested and allocate more into the areas of the market most out of favor. In fact, most experts could not have foreseen the broad stock and bond market rally we witnessed in January, especially in light of decreasing corporate profits and the threats of a looming recession. Dollar cost averaging[4] in pensions and 401k’s are one of the best approaches to continuously investing through strong and weak markets, no matter the inevitable human emotions of greed and fear to different market cycles.

Different traditional signals are telling us that a recession is on the horizon in 2023. However, by the time a recession is declared, the markets have usually begun rallying on the hopes of better days ahead, often through monetary and fiscal stimulus supporting consumers and businesses.

A year ago you received virtually no interest on your cash, whether in the bank, money market accounts or US treasuries. Today, depositors are receiving attractive yields on their cash, far higher than what anyone has received in years. This has led many to explore options to significantly increase the yields on their deposits in comparison to the low amounts of interest they are still receiving on bank deposits.

Real estate downturns typically lag the financial markets by about 12 months. Interest and mortgage rates are far higher than we have seen in years, and this will likely put a lot of pressure on different parts of the real estate market in 2023.

In light of the world conflicts and the ongoing atrocities in the Ukraine, we are reminded how fortunate we are to live in a great country like the United States. A year ago, we couldn’t imagine Russia invading Ukraine yet alone the conflict still raging over a year later.

This decade has already provided us two of what we affectionately call “Black swan events,” between the Covid pandemic and the Ukraine-Russia war. These events reinforce that in life we always need to be ready for the unexpected because unfortunately nothing is linear. We are concerned about the inherent economic challenges from a possible recession and from decreased business lending along with the potential impact locally from a possible Writers Guild strike. Please let us know if there have been any significant changes in your life where a meeting will be helpful to review or recalibrate any goals, needs and/or planning expectations.

I don’t take your trust in our firm lightly and our team will do whatever possible to work together with you to help navigate through the inevitable challenges and opportunities that lie ahead in 2023 and beyond.

Sincerely,

Jeff Fishman

________________________________________

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase, sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

Dollar Cost Averaging-Dollar-cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period of time, regardless of price.

[1] https://www.cnbc.com/2022/12/14/fed-rate-decision-december-2022.html

[2] https://www.bankrate.com/banking/federal-reserve/how-much-will-fed-raise-rates-in-2023/

[3] https://clearingcustody.fidelity.com/app/literature/item/9860886.html

[4] https://www.investopedia.com/terms/d/dollarcostaveraging.asp

Read more