Recent Updates

25 April

Steady Highs for Spring

Quick Take: Stock markets join interest rates in staying higher for longer as economic strength continues.[1]

Back in 2022, the phrase “higher for longer” had a tendency to strike fear in markets. The concern was that interest rates would stay high for too long and squash growth.

Now that we seem to be on the cusp of an economic soft landing and a rate cut cycle – even with the Federal Reserve Bank (“Fed”) pushing out rate cut expectations – assets ranging from stock markets to gold have been sprinting to all-time highs.[2]

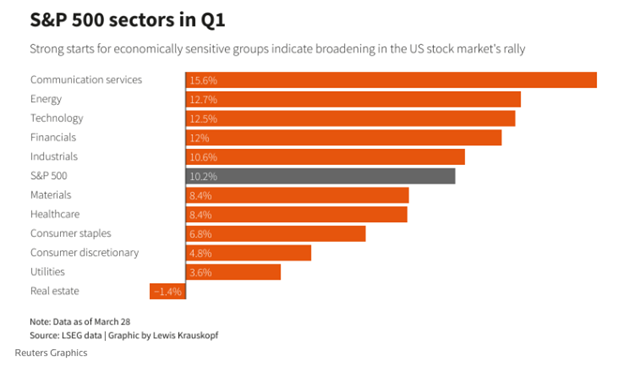

The backdrop for risk-taking has been supportive, according to BlackRock strategists, as market confidence grows with Fed messaging and falling inflation.[3] Benchmark U.S. stocks gained for a fifth consecutive month in March, as the S&P 500 closed out its strongest first quarter since 2019, up 10.2% (+3.1% for the month).[4]

Source: https://www.bloomberg.com/opinion/articles/2024-04-02/rate-cuts-a-longer-for-higher-good-friday-from-the-fed

Bond yields and prices have been relatively stable, with benchmark 10-year Treasury yields effectively trading in a range around 4.25% for the last 18 months.[5] Since the end of 2023, bond yields have risen (prices lower), leaving stocks as the clear outperformer.[6]

Market Tailwinds

Solid corporate earnings, falling inflation, and upcoming interest rate cuts have provided tailwinds for stock markets.[7] In the last quarter of 2023, earnings for S&P 500 companies grew at a brisk 10.1% pace, more than double an expected 4.7% increase.[8]

Source: https://www.reuters.com/markets/us/how-us-stock-market-rocketed-through-first-quarter-2024-03-28/

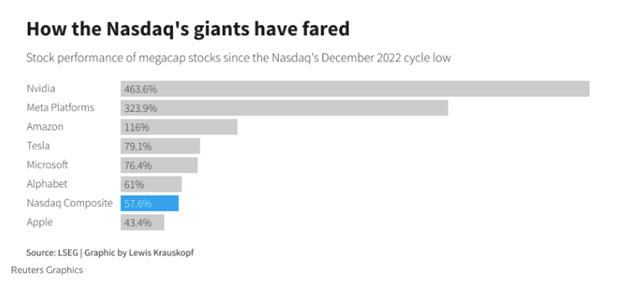

Market breadth is improving. The “Magnificent Seven” top tech and growth stocks fueled around two-thirds of the S&P 500’s gains last year, but so far, they’ve contributed to 37% of first-quarter stock gains, with performance diverging.[9],[10] We are now seeing a broader rally that includes sectors like energy, financials, and industrials.[11]

Underpinning these trends are strong economic growth and labor markets, supporting the February consumer spending that rose the most in just over a year.[12]

February job growth exceeded consensus expectations, with the addition of 275,000 new jobs.[13] Unemployment increased slightly to 3.9%, but the rate has been under 4% for 25 consecutive months, setting a record going back to the 1960s.[14] With the supply of labor growing, Fed officials have become more comfortable that strong job growth can continue alongside lower inflation.[15] This also gives the Fed cover to maintain higher interest rates for a longer period.

Fed and Market Aligned on 2024 Cuts

Especially given broad economic strength, the battle with inflation is not over and progress has slowed in recent months.[16] The Fed has increased inflation and growth forecasts for 2024 while reiterating that they are fully committed to a 2% target.[17] The road to 2% inflation will likely be bumpy, and the Fed can hold off on rate cuts until data confirms a clearer path.

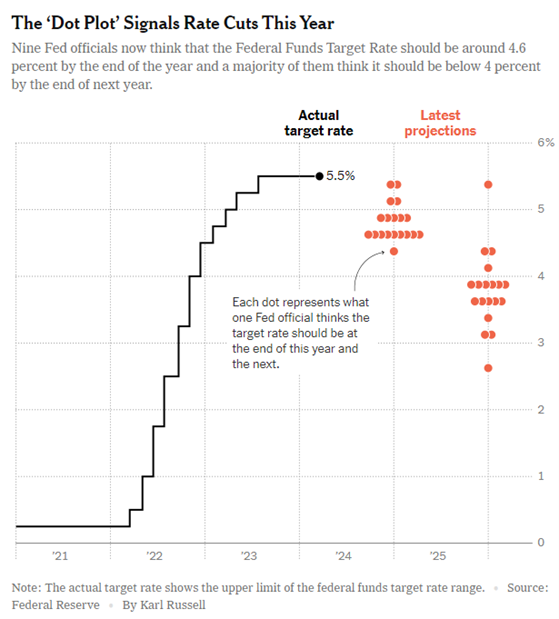

In its March meeting, the Federal Reserve held interest rates steady and released updated interest rate expectations. The market cautiously expects a rate cut by June, and both the market and the Fed expect up to three interest cuts this year.[18]

Source: https://www.nytimes.com/2024/03/20/business/fed-meeting-interest-rates.html

Since the last projections were released in December, the Fed now estimates one less rate cut in 2025 (no changes were made to its 2024 forecast).[19] The new projections effectively slow the pace of expected rate cuts as inflationary forces remain and the economy remains on a more robust path.

Housing Market Insights

Evolving rate expectations impact borrowing costs and, ultimately, homebuyers.

The average borrower in America, as implied by the mortgage-backed securities market, has a mortgage rate of about 3.8%.[20] Many of those borrowers are not looking to sell because they’d end up with a higher rate when purchasing a new property. On an average mortgage of around $450,000, the monthly payment with a 3% mortgage rate is $1,800, but at a 7% rate, it’s $3,000.[21]

Source: https://www.freddiemac.com/pmms

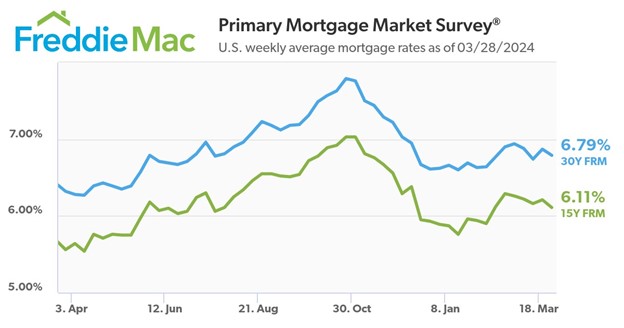

Mortgage rates have retreated from their October peak, though they remain just below 7%, above levels from one year ago.[22] America’s housing market has seen fewer transactions due to higher borrowing costs and tight housing inventory. The NAR reported that last year, existing home sales dropped by 19% in 2023 to the lowest activity level since 1995.[23]

However, housing activity is showing a glimmer of activity. In February, existing home resales were up 9.5%, the largest monthly increase in a year.[24] Median prices for new homes have retreated to a 2.5-year low,[25] just as lower borrowing costs may be on the horizon. It may be a while before rates drop significantly though. Goldman Sachs expects mortgage rates to stay above 6% through 2025.[26]

The good news for homebuyers is that a March antitrust settlement could provide some relief through lower housing transaction costs.[27] This development comes after litigation against the National Association of Realtors (NAR) accused brokerages of inflating sales commissions. The settlement will likely change decades-old commission rules by making it easier for buyers to negotiate fees or use no agents at all.[28] Estimates suggest homebuyers could soon save $12,500 in commission costs on a median-priced home worth $417,500.[29]

Looking Ahead

The first quarter earnings season kicks off in April, and we will find out more about corporate profitability, which rose to an all-time high at the end of 2023.[30],[31] Markets may also take a breather from the rousing start to the year.

We know that the headlines on Wall Street don’t always reflect the realities of Main Street when dealing with rising costs and waves of job turnover. The lack of affordability in the housing market is another signal of the challenges many Americans face.

We’re reminded that life events, as with the seasons, often move in cycles of transformation and renewal. Difficulties are often replaced with opportunities, and change is the only constant. Further, we know that the headlines and noise surrounding the upcoming election will only increase and understand if you become more concerned about the markets’ future trajectory. We are here to support you through it all– please don’t hesitate to reach out to us about any updates in your financial or personal life that may impact our planning with you.

As the green shoots of spring appear, may the seeds planted today blossom into growth tomorrow. We wish you a warm and joyful spring season!

Your Friends at JSF

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase, sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

TLT-iShares 20 Plus Year Treasury Bond ETF seeks to track the investment results of an index composed of US Treasury bonds with remaining maturities greater than twenty years.

The Nasdaq Composite is a market-capitalization-weighted index consisting of all Nasdaq Stock Exchange listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds or debenture securities.

Treasury Bond- is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP is the most commonly used measure of economic activity.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] Why the Stock Market Rally May Have Even Further to Go – Bloomberg

[2] Gold takes a breather after record, Fed-fuelled rally | Reuters

[3] How the US stock market rocketed through the first quarter | Reuters

[4] S&P 500 closes at a fresh record, posts strongest first-quarter performance since 2019 | CNBC

[5] Rate Cuts: A Higher-for-Longer Good Friday From the Fed – Bloomberg

[6] Rising bond yields haven’t kept tech stocks from outperforming – and have created this buying opportunity, says BlackRock | Morningstar

[7] BII Global weekly commentary (blackrock.com)

[8] Wall St Week Ahead Investors eye Fed rate cut, earnings as key to sustaining market rally | Reuters

[9] The Magnificent 7 are no longer the only stocks driving S&P 500 to record highs | Morningstar

[10] How the US stock market rocketed through the first quarter | Reuters

[11] How the US stock market rocketed through the first quarter | Reuters

[12] US inflation moderating; consumer spending underpinning economy | Reuters

[13]Explainer: Charting the Fed’s economic data flow | Reuters

[14] Applications for US unemployment benefits dip to 210,000 in strong job market | AP News

[15] Explainer: Charting the Fed’s economic data flow | Reuters

[16] https://abcnews.go.com/Business/fed-chair-jerome-powell-pumps-brakes-rate-cuts/story?id=108792470

[17] https://www.bloomberg.com/news/newsletters/2024-03-22/the-fed-will-stake-its-reputation-on-2-inflation-target

[18] Wall St Week Ahead Investors eye Fed rate cut, earnings as key to sustaining market rally | Reuters

[19] Fed Holds Rates Steady and Projects Three Cuts This Year | The New York Times

[20] ADA Formatting Sample (goldmansachs.com)

[21] ADA Formatting Sample (goldmansachs.com)

[22] Mortgage Rates | Freddie Mac

[23] Home Sales Were the Lowest in Almost 30 Years in 2023 | The Wall Street Journal

[24] February home sales spike 9.5%, the largest monthly gain in a year, as supply improves | CNBC

[25] US new home sales fall; median price lowest in more than 2-1/2 years | Reuters

[26] CHART OF THE DAY: Mortgage rates will stay above 6% through 2025, Goldman Sachs says (yahoo.com)

[27] Home buying costs could fall in big US real estate group settlement | Reuters

[28] Home buying costs could fall in big US real estate group settlement | Reuters

[29] Home buying costs could fall in big US real estate group settlement | Reuters

[30] Wall St Week Ahead Investors eye Fed rate cut, earnings as key to sustaining market rally | Reuters

[31] Corporate profits are booming. Biden wants that to be a campaign issue. (yahoo.com)

Read more

16 April

Record High Stocks Across the Board Copy

Quick Take: Major stock indices continued to reach all-time highs, as the Nasdaq joined the party.[1] Expectations of fewer rate cuts did little to dampen the rally.

February saw the stock market surge again, as the S&P 500 kicked off its best start to the year (S&P 500 +5.2% in February) since 2019.[2] Market breadth was strong, reflecting a wider recovery across sectors with over 71% of stocks in the S&P posting positive returns.[3]

Investors pushed interest rate cut expectations later into 2024, putting downward pressure on US Treasury bond prices.[4] Rates on 10-year US Treasury yields finished February with its largest monthly increase since the last quarter of 2023 – resulting in lower prices.[5]

Tech Dominance (Again)

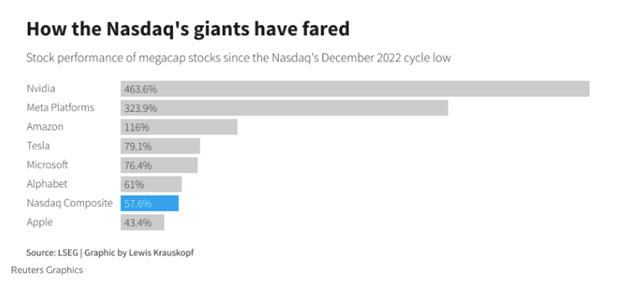

The major indices, Dow Jones Industrial Average and S&P 500, had been drumming up a string of record highs since December 2022 and late January 2023, respectively. [6] The rally hit a closing low in December 2022 as investors dumped high value growth stocks sensitive to high rates, leaving the Nasdaq down more than 30% from its November 2021 record high. [7]

Source: https://www.reuters.com/markets/us/futures-ease-caution-prevails-ahead-inflation-data-2024-02-29/

Since then, the Nasdaq has risen 24%.[8] The Nasdaq’s rise has been led by Nvidia, whose 250% rise over the past year had understandably given investors pause, but its jaw dropping 265% rise in quarterly revenues silenced doubters.[9] The results released late February blew past the most optimistic estimates of Wall Street analysts.[10]

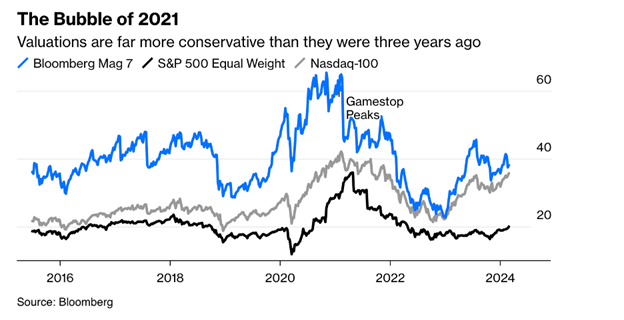

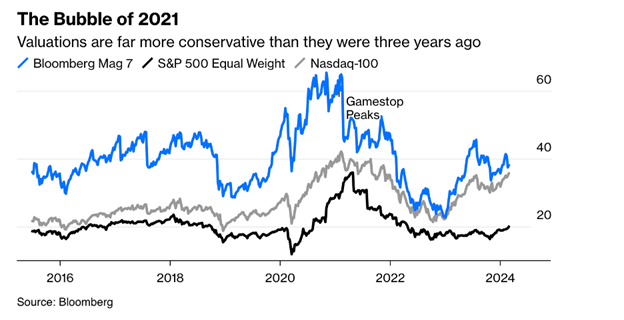

Bubble Talk

Each record high has naturally sparked discussion around a bubble, though Bridgewater founder Ray Dalio notes that the US stock market does not seem to be in a speculative bubble.[11] According to Dalio, although the Magnificent 7 tech stocks leading the charge seem a bit frothy (when assets prices are detached from true intrinsic value), he believes sentiment is still bullish and doesn’t see excessive leverage.[12]

Source: https://www.bloomberg.com/opinion/articles/2024-03-04/gold-rally-the-fed-isn-t-gonna-carry-that-weight?srnd=undefined

Stock valuations are technically far more conservative now than they were three years ago, when meme stocks drove tech names higher.[13] In other words, current prices, while high, are not completely absurd. Of course, the collective expectation that a bubble hasn’t arrived yet could possibly propel gains.

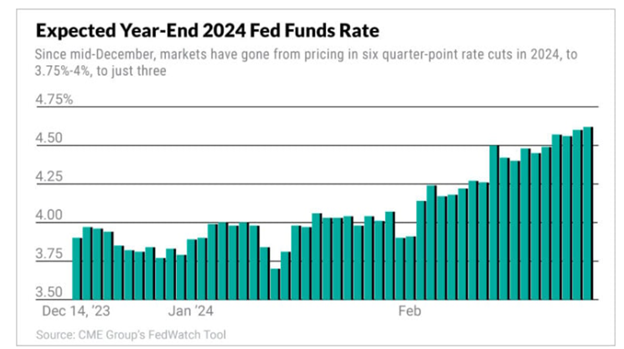

Fewer and Later Rate Cuts

So where does monetary policy figure in all of this? The Fed has remained cautious in its rhetoric, given the economy’s remarkable resilience. Although US prices increased in January, the annual inflation figure was the lowest in three years, which keeps a mid-year interest rate cut on the table.

Source: https://www.investors.com/news/economy/fed-rate-cuts-federal-reserve-sp-500/

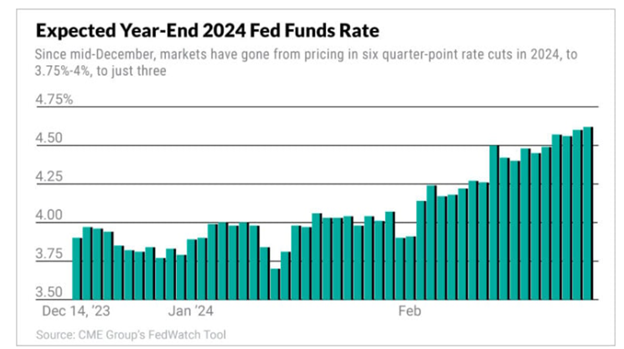

Since mid-December, markets have gone from expecting six quarter-point rate cuts this year to just three. Three cuts fall right in line with the Fed’s guidance from December.[14]

Fed chair Jay Powell has emphasized the importance of getting the timing of rate cuts right. Starting too early could reverse the progress on inflation and require even tighter policy.

How have markets been so resilient when they now expect fewer interest rate cuts? The reality is that the economy is barely slowing down, and the Fed pivot – the announcement that rates have peaked – has offered a strong tailwind to growth since December.[15] With inflation looking relatively tame, continued strength in the US economy, and a strong employment market, a slower start to the rate-cut cycle might not faze investors. Wall Street strategists have had to scramble to upgrade stock market forecasts.[16]

This is a big shift from near-certain talk of recession going into 2023.

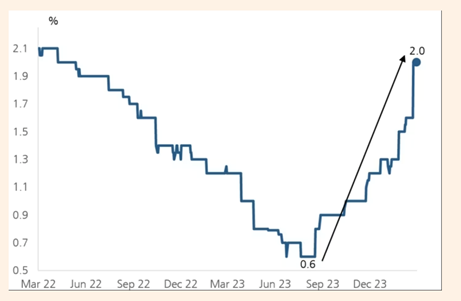

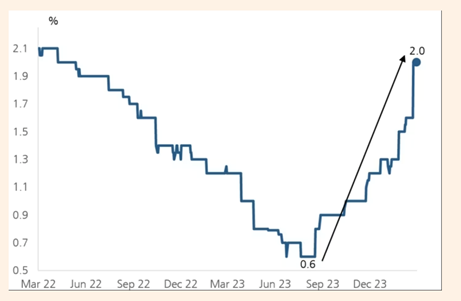

This chart of US forecasts for economic growth as measured by real Gross Domestic Product (GDP) in 2024 shows the about-face.

Source: https://www.ft.com/content/0d58cb77-c771-4b05-8e7b-fca2a53e4912

Looking Ahead

Where do we go from here, with stocks at all-time highs? The S&P 500 has risen 7.5% more since reaching all-time highs last December, which tends to make investors nervous about the possibility of a drop.[17]

At this point the hardest thing to do, yet usually the most reasonable, is to stay invested. It’s impossible to predict the direction of the market, and often a fool’s errand to try. Time in the market is more important than timing the market. However, if you anticipate needing funds in the next 6 to 12 months, we believe it is a good time to raise cash.

Looking back in history hints at this – US stocks have been at a record high in 30% of the all the months going back to 1926.[18] In fact, the market often outperforms in the 12 months after reaching an all-time high.[19] Staying in the market delivers meaningful benefits, whereas if you switched into cash at similar points, over 10 years you would have lost 23% of your wealth.[20]

Of course, history doesn’t always repeat itself. Markets tend to follow their own course without taking instructions from the past. They are also meant to be forward looking.

As the first quarter of 2024 ends and we welcome longer spring days with more sunshine, we hope to reconnect soon if we haven’t yet spoken in the new year. Tax season is in full swing, and 1099s continue to become available. The IRA and Roth IRA deadlines are also upon us, mirroring the tax deadline of April 15th. If you have questions, don’t hesitate to reach out to us or your trusted tax professionals as these critical deadlines approach.

As life presents fresh challenges and opportunities, we are committed to providing you a resilient financial strategy that adapts to your evolving needs while keeping your long-term goals in focus. Thank you for your ongoing trust in us and Happy Spring!

Your Friends at JSF

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase, sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

TLT-iShares 20 Plus Year Treasury Bond ETF seeks to track the investment results of an index composed of US Treasury bonds with remaining maturities greater than twenty years.

The Nasdaq Composite is a market-capitalization-weighted index consisting of all Nasdaq Stock Exchange listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds or debenture securities.

Treasury Bond- is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP is the most commonly used measure of economic activity.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

Sources:

[1] Nasdaq notches first record high close since 2021 | Reuters

[2] S&P 500 Notches Best February In 9 Years (forbes.com)

[3] S&P 500 Notches Best February In 9 Years (forbes.com)

[4] Review of markets over February 2024 | J.P. Morgan Asset Management (jpmorgan.com)

[5] 10-year Treasury yield ends with biggest monthly jump since October | Morningstar

[6] Nasdaq notches first record high close since 2021 | Reuters

[7] Nasdaq notches first record high close since 2021 | Reuters

[8] Climbing can tell us much about stock market peaks (ft.com)

[9] Climbing can tell us much about stock market peaks (ft.com)

[10] Climbing can tell us much about stock market peaks (ft.com)

[11] Ray Dalio says the U.S. stock market ‘doesn’t look very bubbly’ (cnbc.com)

[12] Billionaire Ray Dalio Doesn’t Think the Stock Market Is in a Bubble (businessinsider.com)

[13] Gold Rally: The Fed Isn’t Gonna Carry That Weight – Bloomberg

[14] Federal Reserve keeps key interest rate unchanged | AP News

[15] Hard –> soft –> refuelling landing

[16] Hard –> soft –> refuelling landing

[17] Climbing can tell us much about stock market peaks (ft.com)

[18] Climbing can tell us much about stock market peaks (ft.com)

[19] Climbing can tell us much about stock market peaks (ft.com)

[20] Climbing can tell us much about stock market peaks (ft.com)

Read more

28 March

Record High Stocks Across the Board

Quick Take: Major stock indices continued to reach all-time highs, as the Nasdaq joined the party.[1] Expectations of fewer rate cuts did little to dampen the rally.

February saw the stock market surge again, as the S&P 500 kicked off its best start to the year (S&P 500 +5.2% in February) since 2019.[2] Market breadth was strong, reflecting a wider recovery across sectors with over 71% of stocks in the S&P posting positive returns.[3]

Investors pushed interest rate cut expectations later into 2024, putting downward pressure on US Treasury bond prices.[4] Rates on 10-year US Treasury yields finished February with its largest monthly increase since the last quarter of 2023 – resulting in lower prices.[5]

Tech Dominance (Again)

The major indices, Dow Jones Industrial Average and S&P 500, had been drumming up a string of record highs since December 2022 and late January 2023, respectively. [6] The rally hit a closing low in December 2022 as investors dumped high value growth stocks sensitive to high rates, leaving the Nasdaq down more than 30% from its November 2021 record high. [7]

Source: https://www.reuters.com/markets/us/futures-ease-caution-prevails-ahead-inflation-data-2024-02-29/

Since then, the Nasdaq has risen 24%.[8] The Nasdaq’s rise has been led by Nvidia, whose 250% rise over the past year had understandably given investors pause, but its jaw dropping 265% rise in quarterly revenues silenced doubters.[9] The results released late February blew past the most optimistic estimates of Wall Street analysts.[10]

Bubble Talk

Each record high has naturally sparked discussion around a bubble, though Bridgewater founder Ray Dalio notes that the US stock market does not seem to be in a speculative bubble.[11] According to Dalio, although the Magnificent 7 tech stocks leading the charge seem a bit frothy (when assets prices are detached from true intrinsic value), he believes sentiment is still bullish and doesn’t see excessive leverage.[12]

Source: https://www.bloomberg.com/opinion/articles/2024-03-04/gold-rally-the-fed-isn-t-gonna-carry-that-weight?srnd=undefined

Stock valuations are technically far more conservative now than they were three years ago, when meme stocks drove tech names higher.[13] In other words, current prices, while high, are not completely absurd. Of course, the collective expectation that a bubble hasn’t arrived yet could possibly propel gains.

Fewer and Later Rate Cuts

So where does monetary policy figure in all of this? The Fed has remained cautious in its rhetoric, given the economy’s remarkable resilience. Although US prices increased in January, the annual inflation figure was the lowest in three years, which keeps a mid-year interest rate cut on the table.

Source: https://www.investors.com/news/economy/fed-rate-cuts-federal-reserve-sp-500/

Since mid-December, markets have gone from expecting six quarter-point rate cuts this year to just three. Three cuts fall right in line with the Fed’s guidance from December.[14]

Fed chair Jay Powell has emphasized the importance of getting the timing of rate cuts right. Starting too early could reverse the progress on inflation and require even tighter policy.

How have markets been so resilient when they now expect fewer interest rate cuts? The reality is that the economy is barely slowing down, and the Fed pivot – the announcement that rates have peaked – has offered a strong tailwind to growth since December.[15] With inflation looking relatively tame, continued strength in the US economy, and a strong employment market, a slower start to the rate-cut cycle might not faze investors. Wall Street strategists have had to scramble to upgrade stock market forecasts.[16]

This is a big shift from near-certain talk of recession going into 2023.

This chart of US forecasts for economic growth as measured by real Gross Domestic Product (GDP) in 2024 shows the about-face.

Source: https://www.ft.com/content/0d58cb77-c771-4b05-8e7b-fca2a53e4912

Looking Ahead

Where do we go from here, with stocks at all-time highs? The S&P 500 has risen 7.5% more since reaching all-time highs last December, which tends to make investors nervous about the possibility of a drop.[17]

At this point the hardest thing to do, yet usually the most reasonable, is to stay invested. It’s impossible to predict the direction of the market, and often a fool’s errand to try. Time in the market is more important than timing the market. However, if you anticipate needing funds in the next 6 to 12 months, we believe it is a good time to raise cash.

Looking back in history hints at this – US stocks have been at a record high in 30% of the all the months going back to 1926.[18] In fact, the market often outperforms in the 12 months after reaching an all-time high.[19] Staying in the market delivers meaningful benefits, whereas if you switched into cash at similar points, over 10 years you would have lost 23% of your wealth.[20]

Of course, history doesn’t always repeat itself. Markets tend to follow their own course without taking instructions from the past. They are also meant to be forward looking.

As the first quarter of 2024 ends and we welcome longer spring days with more sunshine, we hope to reconnect soon if we haven’t yet spoken in the new year. Tax season is in full swing, and 1099s continue to become available. The IRA and Roth IRA deadlines are also upon us, mirroring the tax deadline of April 15th. If you have questions, don’t hesitate to reach out to us or your trusted tax professionals as these critical deadlines approach.

As life presents fresh challenges and opportunities, we are committed to providing you a resilient financial strategy that adapts to your evolving needs while keeping your long-term goals in focus. Thank you for your ongoing trust in us and Happy Spring!

Your Friends at JSF

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase, sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

TLT-iShares 20 Plus Year Treasury Bond ETF seeks to track the investment results of an index composed of US Treasury bonds with remaining maturities greater than twenty years.

The Nasdaq Composite is a market-capitalization-weighted index consisting of all Nasdaq Stock Exchange listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds or debenture securities.

Treasury Bond- is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP is the most commonly used measure of economic activity.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

Sources:

[1] Nasdaq notches first record high close since 2021 | Reuters

[2] S&P 500 Notches Best February In 9 Years (forbes.com)

[3] S&P 500 Notches Best February In 9 Years (forbes.com)

[4] Review of markets over February 2024 | J.P. Morgan Asset Management (jpmorgan.com)

[5] 10-year Treasury yield ends with biggest monthly jump since October | Morningstar

[6] Nasdaq notches first record high close since 2021 | Reuters

[7] Nasdaq notches first record high close since 2021 | Reuters

[8] Climbing can tell us much about stock market peaks (ft.com)

[9] Climbing can tell us much about stock market peaks (ft.com)

[10] Climbing can tell us much about stock market peaks (ft.com)

[11] Ray Dalio says the U.S. stock market ‘doesn’t look very bubbly’ (cnbc.com)

[12] Billionaire Ray Dalio Doesn’t Think the Stock Market Is in a Bubble (businessinsider.com)

[13] Gold Rally: The Fed Isn’t Gonna Carry That Weight – Bloomberg

[14] Federal Reserve keeps key interest rate unchanged | AP News

[15] Hard –> soft –> refuelling landing

[16] Hard –> soft –> refuelling landing

[17] Climbing can tell us much about stock market peaks (ft.com)

[18] Climbing can tell us much about stock market peaks (ft.com)

[19] Climbing can tell us much about stock market peaks (ft.com)

[20] Climbing can tell us much about stock market peaks (ft.com)

Read more