AI Fueled Markets Defy Debt Ceiling Drama

Quick Take: Amidst the final stretch of debt ceiling negotiations to avoid a US default, equities and bonds remained resilient, with AI-related names leading the charge.

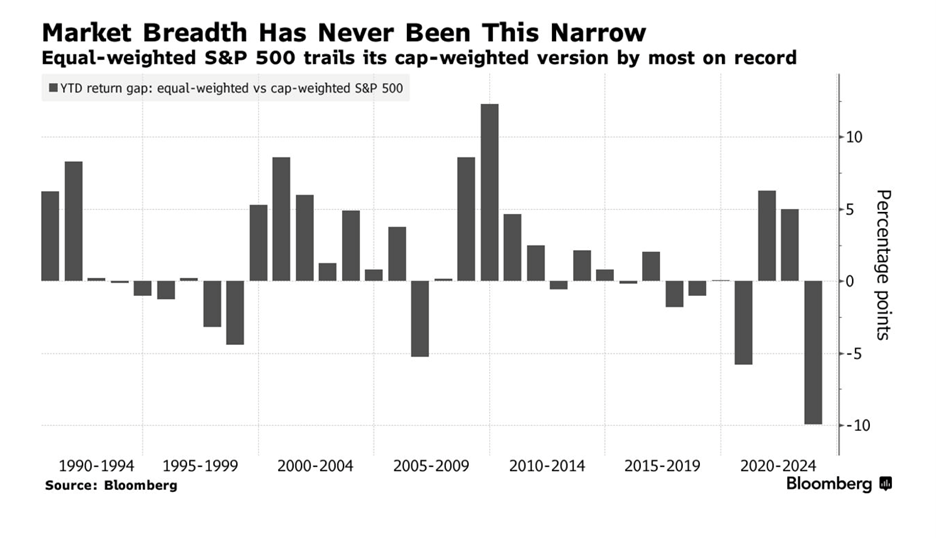

Mega tech companies continued a year-to-date market dominance as the tech-heavy Nasdaq rose 5.8%, outperforming the S&P 500 equity index, which increased 0.3%.[1] Five stocks — Microsoft, Alphabet Inc. (Google parent company), Nvidia, Apple, and Meta Platforms — are responsible for the S&P 500’s entire 9% year-to-date return.[2]

Source:https://www.bloomberg.com/news/articles/2023-05-26/ai-oligarchy-becoming-the-stock-market-s-answer-to-everything?

Never have indexes like the S&P 500 and Nasdaq 100, which are the targets of trillions of dollars in passive investments, relied heavily on so few stocks for performance.[3]

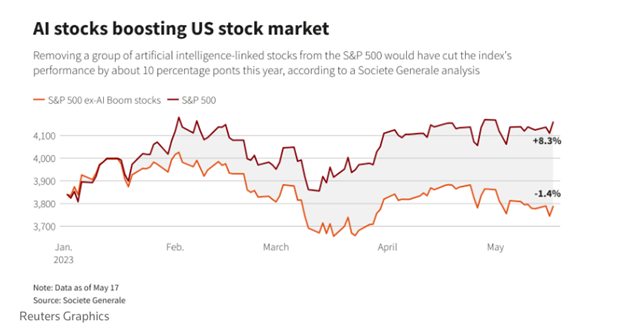

The excitement surrounding the productivity-boosting potential for “generative artificial intelligence” (the technology used to create chatbot ChatGPT) has fueled these stock market gains. Research findings indicate that 25% to 50% of year-to-date S&P 500 gains could be due to the buzz around AI.[4]

Source: https://www.reuters.com/markets/us/wall-st-week-ahead-artificial-intelligence-gives-real-boost-us-stock-market-2023-05-19/

Optimism is reflected in soaring share prices for companies like Nvidia, whose chips play a vital role in development. Nvidia’s shares have tripled in less than eight months, with the market capitalization briefly surpassing $1 trillion in May.[5] Only four other US companies currently have a valuation of more than $1 trillion.[6]

The attention on AI centers around its potential impact. According to Goldman Sachs, generative AI could expand profit margins for S&P 500 companies by 30% or more over the next decade.[7]

Down to the Wire

Riding the wave of AI euphoria, markets traded near 2023 highs even as concerns lingered over ongoing debt ceiling negotiations.[8] Despite no shortage of political theater, markets seemed to believe that the US would ultimately avoid a default Treasury Secretary Yellen warned could have happened on June 5th.[9]

The last-minute deal passed by Congress and signed by President Biden suspends the $31.4 trillion debt ceiling through January 1, 2025, until after the 2024 presidential election.[10] Student loan repayments, which have been on pause since the pandemic, must restart, and non-defense spending will be capped for the next two years, while clean energy measures passed in the Inflation Reduction Act will remain.[11]

Spring Bonds Rally

Source: https://www.bloomberg.com/news/articles/2022-05-30/bonds-rally-everywhere-in-may-with-bulls-saying-selloff-is-over

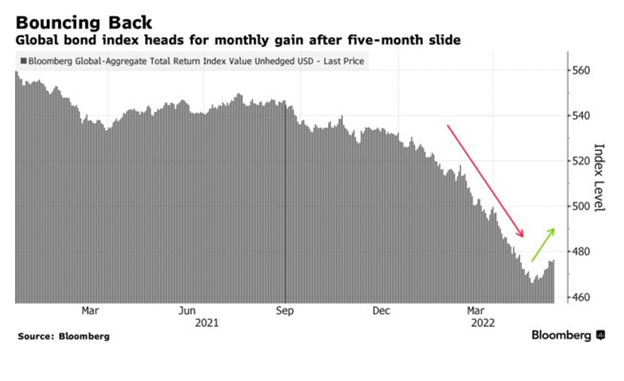

Despite the debt ceiling overhang, bonds enjoyed a spring rally, as US Treasuries logged their best month since November and global corporate debt advanced the most since July.[12] Investors believe central bank rate hikes are mostly priced in, and yields remain at attractive levels to buy bonds. Asset managers like JPMorgan, Morgan Stanley, and PIMCO have gone on record supporting the view that the global debt selloff appears to be over.[13]

That being said, after the debt ceiling deal, we expect the Treasury to unleash a flood of Treasury bill issuance –debt with maturities under a year — to replenish coffers, which could cheapen Treasury bill prices and potentially draw liquidity from the market.[14]

Fed Guidance

While the debt ceiling debate has reached a near-term resolution, the economy still has an inflation problem that the Federal Reserve (“Fed”) has tried to remedy through increasing interest rates. In early May, policymakers increased the benchmark federal funds rate for the 10th consecutive time to a range of 5.00%-5.25%.[15]

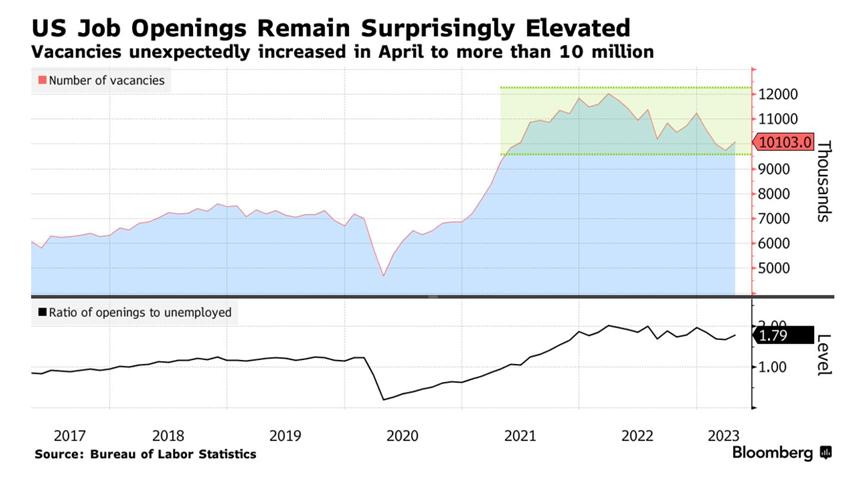

Stronger than expected economic indicators have emerged since the May Federal Open Market Committee (“FOMC”) meeting. The unemployment rate reached a multi-decade low of 3.4% in April, while the Fed’s preferred gauge for inflation stands at 4.4% — still more than double its target.[16] Additionally, job vacancies unexpectedly surged in April to the highest level in three months.[17] These factors give the Fed more reason to consider hiking interest rates soon.

Source: https://www.bloomberg.com/news/articles/2023-05-31/us-job-openings-surge-to-10-1-million-exceeding-all-estimates?cmpid=BBD053123_BIZ&utm_medium=email&utm_source=newsletter&utm_term=230531&utm_campaign=bloombergdaily

However, minutes from the FOMC meeting showed that policymakers generally agreed that the need for further rate hikes “had become less certain”.[18] Fed policymakers have recently signaled the likelihood of taking a break from hiking rates during the next June 13-14 meeting.[19] [20] However, a decision to maintain the current policy rate in favor of a wait-and-see approach doesn’t mean we’re at the peak rate for this cycle. Rather, many believe we are nearing the finish line for future rate hikes.

Looking Ahead

Although strong economic data seems to have lessened the risk of a near-term recession, the full effects of central bank tightening have not yet materialized. Moving into the second half of the year, we anticipate continued doses of market volatility. As a result, prioritizing portfolio diversification and following a prudent investment strategy remains critical.

As summer approaches, we’d like to extend our heartfelt congratulations to all graduates and their families. We celebrate your achievements and look forward to seeing what the future holds! Additionally, here’s a special shout out to the dads as we shine a light on you during your upcoming festivities – Happy Father’s Day!

Lastly, a reminder that our office will be closed on Monday, June 19th for the Federal Holiday of Juneteenth. Banks, as well as the stock markets, will be closed that day. JSF will reopen under normal business hours on Tuesday, June 20th.

Wishing everyone a wonderful start to summer festivities and the (un)official start to travel season!

Your Friends at JSF

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase, sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

The Nasdaq Composite is a market-capitalization-weighted index consisting of all Nasdaq Stock Exchange listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds or debenture securities.

Treasury Bond- is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP is the most commonly used measure of economic activity.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] Stock Market Today: Dow Down at Close As Traders Await Debt-Ceiling Vote (wsj.com)

[2] Wall Street Week Ahead: Artificial intelligence gives real boost to US stock market | Reuters

[3] AI Is Becoming the Stock Market’s Answer to Everything (yahoo.com)

[4] Wall Street Week Ahead: Artificial intelligence gives real boost to US stock market | Reuters

[5] Nvidia briefly joins $1 trillion valuation club | Reuters

[6] Nvidia briefly joins $1 trillion valuation club | Reuters

[7] Goldman Sachs: AI-driven gains could lead to 30% S&P 500 profit spike (cnbc.com)

[8] S&P 500 Hits 2023 High as Attention Grows on Debt-Ceiling Deal – WSJ

[9] Janet Yellen Sets June 5 Deadline for Debt-Limit Accord – WSJ

[10] Here’s what’s in the debt ceiling package | CNN Politics

[11] Here’s what’s in the debt ceiling package | CNN Politics

[12] Bonds Rally Everywhere in May With Bulls Saying Selloff Is Over – BNN Bloomberg

[13] Bonds Rally Everywhere in May With Bulls Saying Selloff Is Over – BNN Bloomberg

[14] Debt deal may provide only short-term market relief | Reuters

[15] U.S. economy little changed, outlook ‘deteriorated’: Fed survey | Reuters

[16] https://www.reuters.com/markets/us/us-consumer-spending-beats-expectations-april-inflation-picks-up-2023-05-26/

[17] US Job Openings Surge to 10.1 Million, Upping Odds for Fed Hike – Bloomberg

[18] Fed agreed need for more rate hikes after May meeting was ‘less certain’ | Reuters

[19] https://www.wsj.com/articles/fed-official-says-rate-pause-doesnt-signal-end-to-hikes-758041e5

[20] A June skip jumps to the fore following latest Fed comments | Reuters