Under Pressure

Quick Take: US equities markets corrected as US long-term bond yields rose above 5%.1

Battered US stocks dipped to five-month lows as both the S&P 500 and Nasdaq (down 2.2% and 2.8%, respectively) fell into correction territory after dropping 10% from July highs.2, 3, 4, 5

During the third-quarter earnings season, even though around 75% of companies beat expectations, stocks were disproportionally sensitive to bad news.6 Momentum in tech stocks turned as the Nasdaq 100 erased about a third of its AI-driven advance.7 As we’ve discussed the last few months, stocks have been under pressure because of a sharp rise in bond yields (prices fell).8

Bond yields softened towards the end of the month (prices rose) after the 30-year bond peaked around 5.18%, and the 10-year surpassed 5% for the first time in 16 years.9 According to Treasury Secretary Janet Yellen, the strength of the economy has driven the rise in bond yields.10

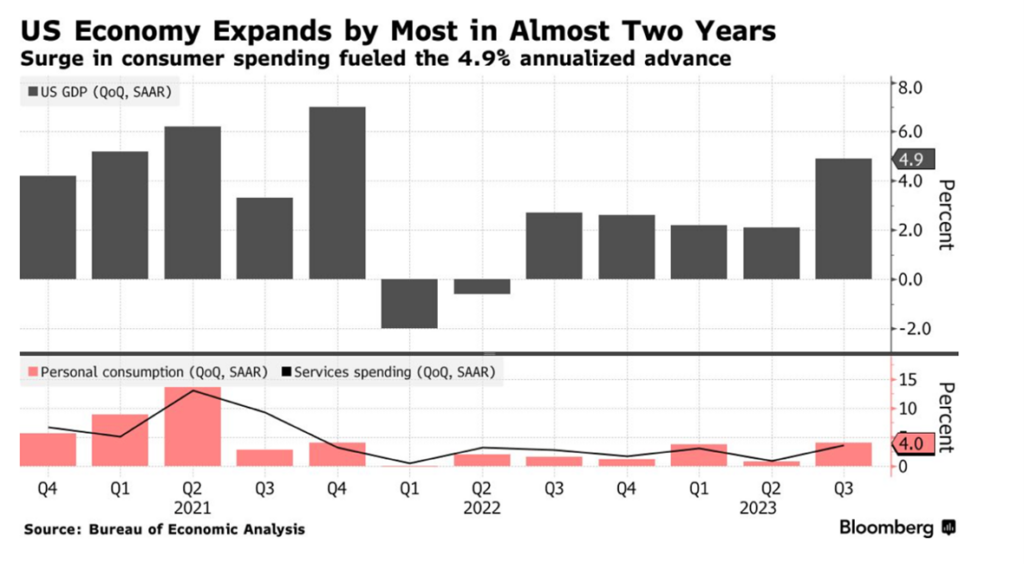

A Strong Economic Pulse

Robust consumer spending drove a stronger-than-expected 4.9% surge in 3rd quarter GDP, the fastest expansion in nearly two years.11 Despite lingering inflation, a tight labor market continues to support household spending, as Americans also borrow and tap into savings.

So why hasn’t the economic strength fueled inflation? US core PCE data, the Fed’s preferred inflation gauge, slowed further in September on falling goods prices.12

Fed Chair Jay Powell noted that despite strong demand, labor supply has also increased, leading to a healthy rebalancing in the employment market.13 In the past year, the labor force grew by about three million people, which is four times the typical long-run rate.14 That’s why wage increases are still coming down.

Geopolitical Tensions

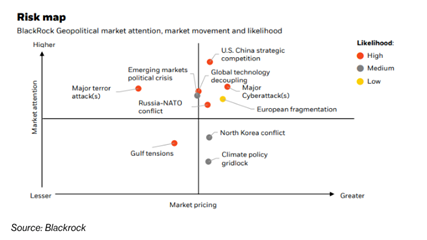

Internationally, tensions have undeniably grown in the global landscape. We are seeing violence from the Israel-Hamas war, a persistent war in Ukraine, and deteriorating U.S.-China relations.15 What has been the impact on markets?

The answer is — outside of local market reactions, not much. The horrors in Ukraine have left the S&P 500 index almost exactly where it was when Putin’s troops invaded.16 Oil and gold have crept higher since the alarming developments in Israel and the Gaza strip, but we haven’t seen a significant “risk-off” move into bonds that might increase prices and depress yields.17 Geopolitical shifts may instead be reinforcing higher interest rates as countries invest in defense spending and reduce trade.18

Source: https://www.blackrock.com/corporate/literature/whitepaper/bii-global-outlook-in-charts.pdf

According to BlackRock, strategic competition between the US and China is one of the top geopolitical risks facing markets worldwide.19 Last year, the US began imposing export controls on cutting-edge semiconductors used for AI, and China has retaliated by restricting exports of critical materials for semiconductor manufacturing.20, 21 Nvidia’s Chief Financial Officer noted that long-term export restrictions will result in a permanent loss of opportunities for the US industry and impact future business and financial results.22

This past month, the Biden administration further toughened restrictions on semiconductor exports. However, there are signs that the US and China may try to reboot ties as President Biden and Chinese leader Xi Jinping agreed in principle to meet at a summit in November.23

Historic Deals Tentatively Reached

Talks between the United auto workers and the Big 3 — GM, Ford, and Stellantis — reached a welcome tentative resolution after six weeks of labor strikes. The expected deals secured record concessions for union members with raises, cost-of-living adjustments, and enhanced profit-sharing bonuses.24 The strike has been the longest US auto strike in 25 years, and the deals are waiting for approval by union members.25

Ford noted that the concessions would add $850-$900 in costs per vehicle assembled. However, the finance chief said they would work to “find productivity and cost reductions to deliver on profitability targets.26 Ultimately, their cars must still compete with the rest of the market, including with nonunionized automakers, which means that car prices won’t necessarily see much of an impact.

While putting the final touches on this month’s newsletter, it was announced that SAG-AFTRA’s negotiating committee reached a deal with studios to end an almost four-month-long strike.27 Board members from the actor’s union voted to ratify the agreement, which includes wage increases and controls surrounding the use of artificial intelligence among other items. Union members will now vote on the agreement over the next several weeks.28 The strike caused much pain in the local economy here in Los Angeles as well as beyond, and we hope that the deal leaves both sides satisfied with the result.

Looking Ahead

In the first week of November, the Fed declined to raise interest rates again. Elevated bond yields ease some of the pressure on the Fed to tighten monetary policy, though a final rate hike for 2023 is still possible. Futures markets indicate around a 70% probability that rates will stay the same at the December Federal Open Market Committee (FOMC) meeting.29

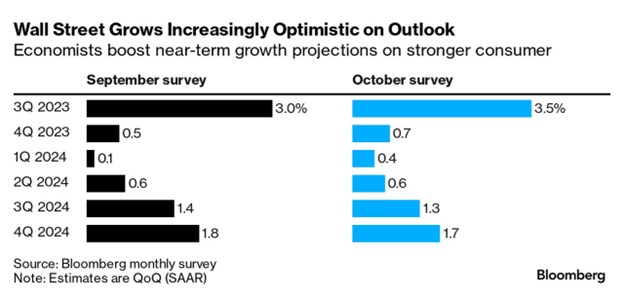

PIMCO believes both growth and inflation have peaked – we may see the economy transition from strength to weakness next year as fiscal support diminishes and the delayed impact of tighter monetary policy materializes.30 Consumer spending also may not be sustainable.

Yet economists have raised US growth projections and lowered odds of a downturn to a one-year low.31

As Schroder’s group chief investment officer Johanna Kyrklund says, valuation matters again – it’s no longer “The fear of missing out (FOMO) but a ‘do your homework’ market.”32

As we navigate the complexities that each new month may bring, we do so with the confidence that comes from a well-thought-out, disciplined investment approach. After all, it’s not about weathering a single storm, but sailing smoothly over decades.

Please reach out if you’ve had any changes in circumstances or goals so that we can make sure your portfolio fits your needs. If you haven’t already, it’s a great time to schedule your year-end review. Wishing you all a Happy Thanksgiving! As we count our blessings, we thank you for trusting us on your financial journey. We are grateful for your continued partnership and confidence through the uncertainty this year has brought us. We hope your day is full of your favorite dishes and memorable time spent with friends and family!

Your Friends at JSF

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase, sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

The Nasdaq Composite is a market-capitalization-weighted index consisting of all Nasdaq Stock Exchange listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds or debenture securities.

Treasury Bond- is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP is the most commonly used measure of economic activity.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

1 https://finance.yahoo.com/news/ackman-gross-abandon-bearish-bond-191916624.html

3 Nasdaq Correction Could Give Way to Buying Opportunity | Nasdaq

4 Wall St closes higher on eve of Fed decision; investors assess earnings | Reuters

5 Stock market today: Live updates (cnbc.com)

6 US stock market correction: What comes next? | UBS United States of America

7 How Low Can It Go? Getting to the Bottom of the Nasdaq Selloff (yahoo.com)

8US stock market correction: What comes next? | UBS United States of America

9https://finance.yahoo.com/news/ackman-gross-abandon-bearish-bond-191916624.html

10Yellen says US GDP is a ‘good strong number’, may keep bond yields higher (yahoo.com)

11Resilient U.S. economy grew at a ‘stellar’ pace over the summer (msnbc.com)

12Inflation Edges Down in September, in Line With Estimates | Economy | U.S. News (usnews.com)

13Fed Takes Heart in a Supply-Side Boom – WSJ

14 Fed Takes Heart in a Supply-Side Boom – WSJ

15 Markets in an Era of Clashing Superpowers – Bloomberg

16 Markets in an Era of Clashing Superpowers – Bloomberg

17 Markets in an Era of Clashing Superpowers – Bloomberg

18 Markets in an Era of Clashing Superpowers – Bloomberg

19 Geopolitical risk dashboard (blackrock.com)

20 How the U.S. Stumbled Into Using Chips as a Weapon Against China – WSJ

21 U.S. Tightens Curbs on AI Chip Exports to China, Widening Rift With Nvidia and Intel – WSJ

22 U.S. Tightens Curbs on AI Chip Exports to China, Widening Rift With Nvidia and Intel – WSJ

23 U.S., China Agree in Principle to Biden-Xi Summit – WSJ

24 UAW: Winners and losers of 2023 talks with GM, Ford, Stellantis (cnbc.com)

26 UAW: Winners and losers of 2023 talks with GM, Ford, Stellantis (cnbc.com)

28 https://apnews.com/article/actors-strike-deal-d5f9769fd8a263170141a60da64cdc98

29 Live updates: Markets rise after Federal Reserve hits pause again on rate hikes (cnn.com)

30 Cyclical Outlook: Post Peak | PIMCO

31 Bloomberg Evening Briefing: The US Economy Just Had a ‘Stellar Summer’ – Bloomberg

32 Markets in an Era of Clashing Superpowers – Bloomberg