A Wealth of Data, and A Bit of Worry

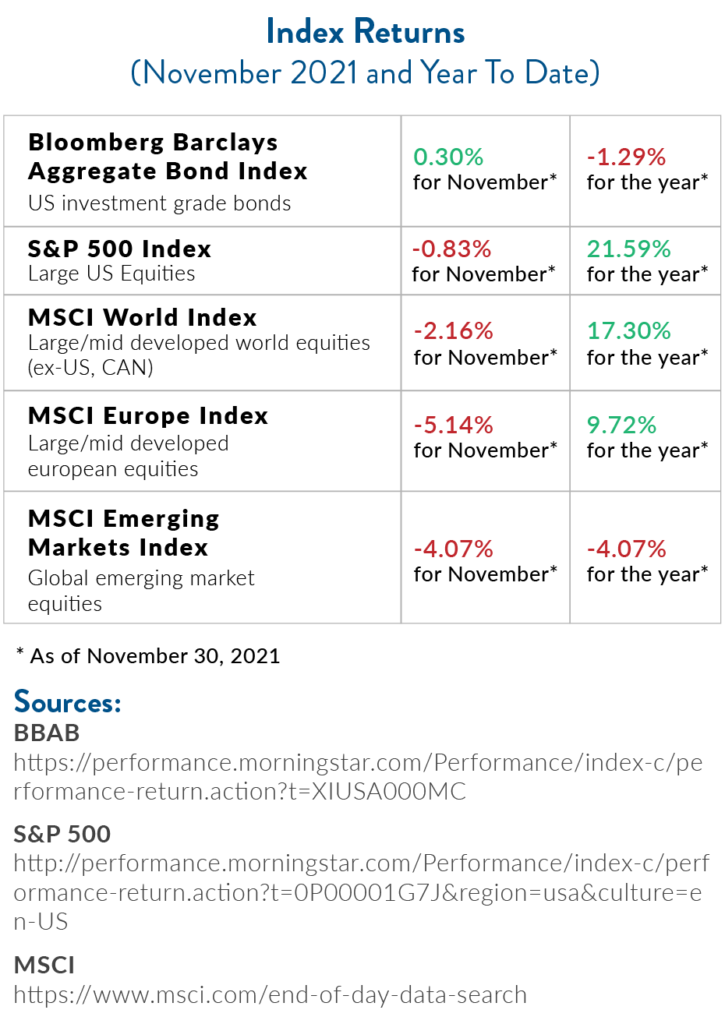

Typically, the day after Thanksgiving is one of the quietest trading days of the year.[1] But this year Black Friday turned into “Bleak Friday” after the World Health Organization raised the alarm about the Omicron variant of COVID-19, first identified earlier in the month in South Africa. Equity markets dropped, reversing earlier gains, and only the Nasdaq ended the month in positive territory.

A Strong Start

A Strong Start

After solid corporate earnings and the passage of the $1 trillion infrastructure bill, the S&P 500 logged a record 66th all-time high in November, hitting 11 straight months of record highs.[2]

The month also started with higher-than-expected jobs growth numbers for October, with 531,000 new jobs created,[3] and jobless claims for the week ending November 20 decreased to their lowest levels since November 1969.[4]

However, jobs growth slowed down sharply in November—the U.S. added just 210,000 jobs compared to the expected 573,000.[5] While this sharp drop might seem worrisome, it’s notable that it also accompanied a sharp fall in unemployment: the overall unemployment rate fell to 4.2% from 4.6% the month before. The broader unemployment rate, which includes discouraged workers, also tumbled, falling to 7.8% from the previous month’s 8.3%.

In other words, while we’re still seeing some mixed data, the underlying employment situation does appear to be strengthening.

The Rise of Omicron

While we think we can safely say that we are all tired of COVID, the virus does not appear to be done with us.

The WHO believes that global risk of the new Omicron variant is currently “very high” because of the increased number of mutations and potentially higher levels of transmissibility.[6] However, it’s worth remembering that we have many more tools at our disposal now to manage the virus, including vaccines and therapeutics. Initial anecdotal reports from the South African Medical Association also indicate the variant has presented relatively mild symptoms so far, particularly in vaccinated people.[7]

The WHO believes that global risk of the new Omicron variant is currently “very high” because of the increased number of mutations and potentially higher levels of transmissibility.[6] However, it’s worth remembering that we have many more tools at our disposal now to manage the virus, including vaccines and therapeutics. Initial anecdotal reports from the South African Medical Association also indicate the variant has presented relatively mild symptoms so far, particularly in vaccinated people.[7]

Unfortunately, the markets took the news on the chin, though the dip may have been exaggerated because the WHO statements on Omicron came on one of the lowest market volume days of the year.[8] In our view, the prompt arrival of contradictory information, exaggerated estimates of risks, and circulation of worst-case scenarios by talking heads didn’t help.

The reality is that not enough is known right now about the variant to create a coherent assessment of its risks. That said, preliminary data was described as “encouraging” by the White House chief medical advisor Dr. Anthony Fauci.[9] We’ll simply have to wait and see.

In remarks from the White House, President Biden indicated there are no plans for a lockdown, as the percentage of vaccinated people is up and people continue to wear masks.[10] However, in response to potential transmission risks, the U.S. tightened travel testing requirements and instituted travel bans from South Africa and seven other Southern African nations.[11]

Dropping “Transitory” and Possibly Ending Bond Purchases Early

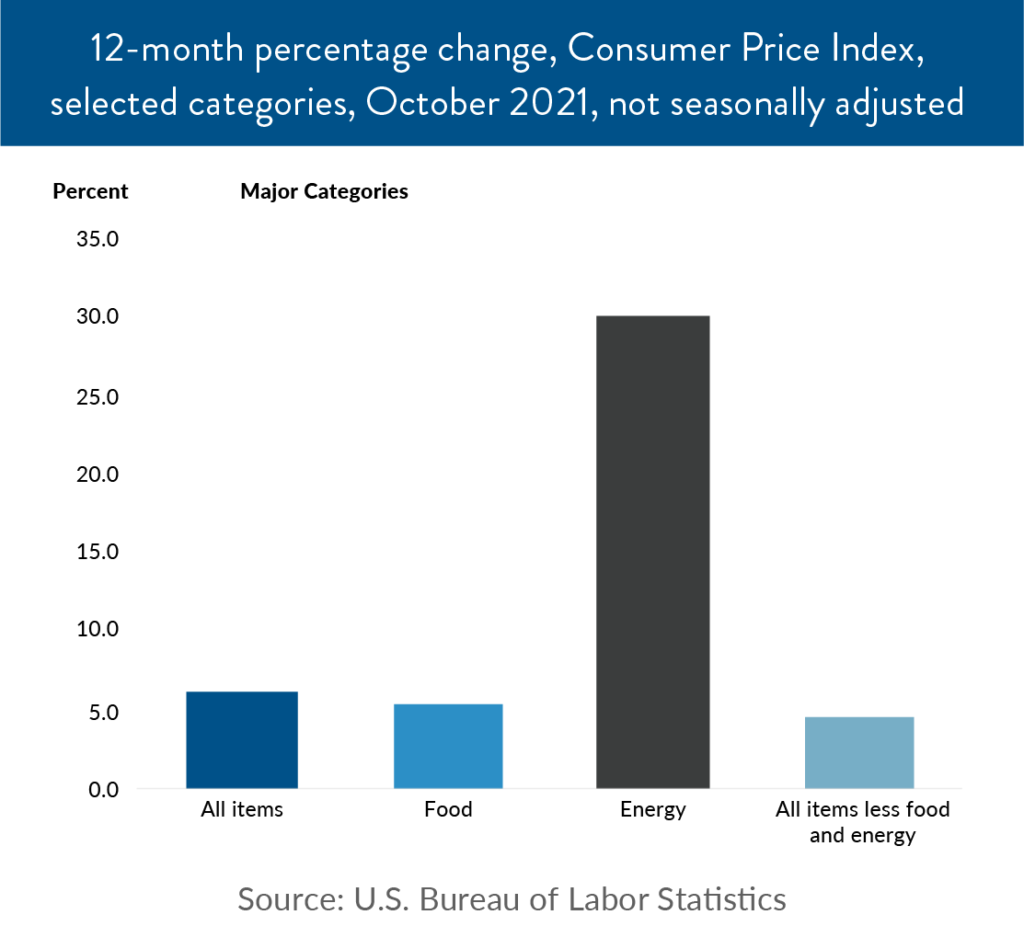

As part of that story, inflation numbers remain high. The Consumer Price Index (CPI), a measure of the average changes in the prices over time that consumers pay for a basket of goods and services, was up 6.2% for the year through October.[12] Fed Chair Jay Powell, freshly re-appointed to another term, conceded on the last day of November that it’s time to retire the word “transitory” when describing inflation.[13]

Back in July, Chair Powell spent several minutes trying to clarify the Fed’s definition of transitory, explaining that they don’t expect higher prices to leave behind persistent inflation.[14] But transitory also can imply short-lived, and supply chain issues have certainly lasted longer than expected.

All that said, economists still expect inflation to cool off next year.[15]

Tis the Season

Inflation, COVID-19 variants, boosters, travel restrictions—it can certainly start to feel like an endless pandemic hamster wheel. However, from an investment perspective, we believe there’s still a lot to appreciate.

Despite a choppy November, the S&P 500 is still up over 20% for the year, with record highs, strong earnings, and an improving labor market.12 Investors who’ve stuck with the market and their longer-term strategic plan have enjoyed the fruits of riding out volatility.

Now that we’re heading into year-end, it’s a good time to think about our final tax planning strategies and charitable donation planning for 2021. Check your inbox for our tax planning newsletter for more information—and of course, while you’ll likely hear from us in the meantime, please don’t hesitate to reach out if you’d like to check in once more before we welcome the New Year.

Now that we’re heading into year-end, it’s a good time to think about our final tax planning strategies and charitable donation planning for 2021. Check your inbox for our tax planning newsletter for more information—and of course, while you’ll likely hear from us in the meantime, please don’t hesitate to reach out if you’d like to check in once more before we welcome the New Year.

As always, thank you for your loyalty and support this year and every year. We’ve had some extraordinary growth here at the office, and we’re thankful every day to get to work with such an incredible group of clients. Wishing you a happy holiday season and a healthy and prosperous New Year!

Click to view print version of this article.

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase or sale of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Europe Index captures large and mid-cap representation across 15 developed markets countries in Europe and covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP is the most commonly used measure of economic activity.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

Sources:

[1] https://www.npr.org/2021/11/27/1059490192/the-dow-just-had-its-worst-day-all-year

[2] https://markets.businessinsider.com/news/stocks/sp-500-12-straight-monthly-record-highs-coronavirus-markets-omicron-2021-12

[3] https://news.yahoo.com/october-2021-jobs-report-labor-department-hiring-covid-shortages-180531280.html

[4] https://news.yahoo.com/october-2021-jobs-report-labor-department-hiring-covid-shortages-180531280.html

[5] https://www.cnbc.com/2021/12/03/jobs-report-november-2021.html

[6] https://www.nbcnews.com/news/world/warns-omicron-covid-variant-poses-high-global-risk-rcna6892

[7] https://timesofindia.indiatimes.com/world/rest-of-world/south-african-medical-association-says-omicron-variant-causes-mild-disease/articleshow/87949404.cms.

[8] https://www.marketwatch.com/story/the-omicron-panic-is-overdone-buy-the-dips-in-these-stocks-says-jpmorgan-11638447971?siteid=yhoof2&yptr=yahoo.

[9] https://www.cnbc.com/2021/12/06/omicron-covid-variants-risk-profile-starts-to-emerge-with-early-data-.html

[10] https://www.bbc.com/news/world-us-canada-59469486

[11] https://www.cnbc.com/2021/12/02/omicron-covid-variant-us-tightens-travel-testing-requirements-mask-mandates.html

[12] https://www.nasdaq.com/articles/november-2021-review-and-outlook

[13] https://www.marketwatch.com/story/powell-says-time-to-retire-transitory-when-talking-about-inflationand-stock-markets-tank-11638305094.

[14] https://www.marketwatch.com/story/powell-says-time-to-retire-transitory-when-talking-about-inflationand-stock-markets-tank-11638305094

[15] https://www.bloomberg.com/news/articles/2021-12-02/fed-officials-backing-faster-taper-mount-amid-high-inflation

Performance table sources:

BBAB: https://performance.morningstar.com/Performance/index-c/performance-return.action?t=XIUSA000MC