A Stormy September

Quick Take: Equity and bond markets swooned while the Federal Reserve (“Fed”) remained committed to aggressive rate hikes.[1]

According to the Stock Trader’s Almanac, September has historically been the toughest month of the year for stocks.[2] Going back to 1928, the S&P 500 has seen a September decline 11 times of at least 7%, including declining 9.1% in 2008.[3]

Once again, sweltering summer heat turned into a stormy September as the S&P 500 posted a 9.3% loss for the month, ending the 3rd quarter down 4.9%.[4] 10-year yields, a benchmark for borrowing costs, spiked to about 4.019%, the highest level since October 2008. The long-term trend of decreasing yields (increasing prices) over the last 35 years appears to have clearly ended, leaving beaten-down bond prices looking relatively attractive.[5],[6]

Source: https://www.bloomberg.com/opinion/articles/2022-09-23/bond-yields-leave-the-ice-age-as-post-volcker-trend-ends-for-world-economy

Selloffs of this nature, while unpleasant, have had their foothold in history. It’s important to remember that over the long run, investors are typically rewarded for staying invested rather than trying to time the market.[7]

In this note, we’ll review the Fed actions from their September meeting, global uncertainty, and the bigger picture.

The Fed Stays Committed

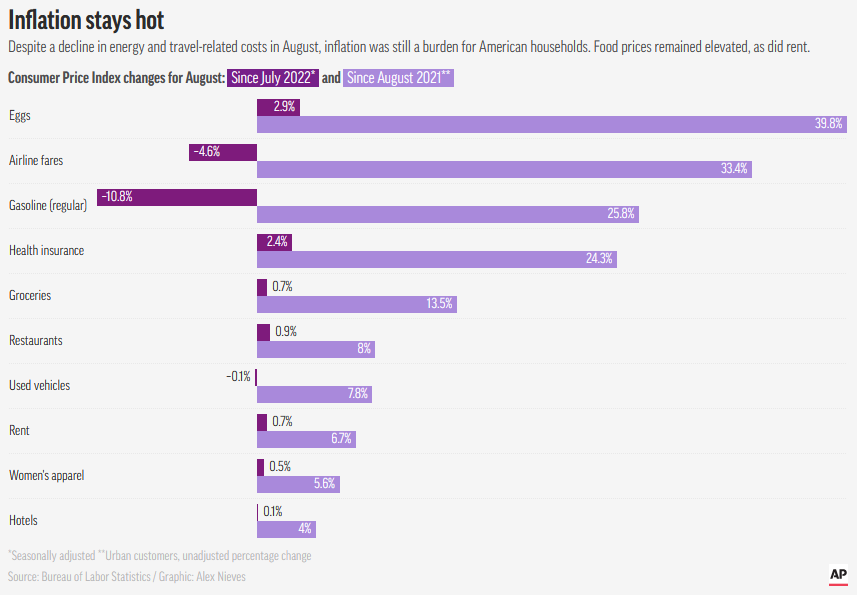

After the Fed’s tough talk in Jackson Hole in August, all eyes were on inflation data. Despite initial signs of peaking inflation, stubbornly high inflation rates are still far above Fed targets, which requires the Fed to stay aggressive.[8] August core inflation numbers that exclude food and energy rose faster than they did in July, casting a pall over markets.[9]

Source: https://apnews.com/article/inflation-economy-prices-f2270f4c6ac55c084108d57cc1aec53a

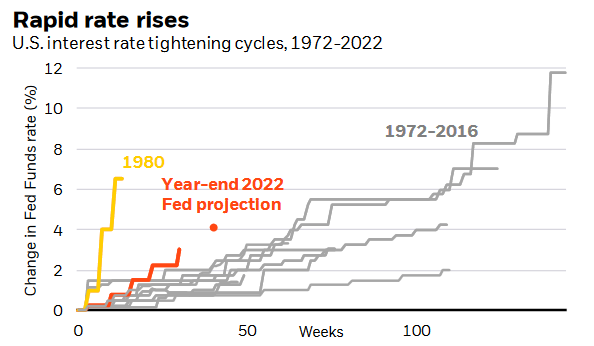

As expected, the Fed raised rates by 75 bps and then projected rates would go even higher.[10],[11] The Fed now expects the fed funds rate to rise to 4.6% by the end of 2023, a significant increase from prior guidance.[12]

Source: https://www.blackrock.com/corporate/literature/market-commentary/weekly-investment-commentary-en-us-20220926-sour-fed-growth-view-not-dour-enough.pdf

Already, the Federal Reserve is on its fastest rate hiking cycle since the early 1980s.[13] The commitment to raising rates remains strong – analysts at PIMCO forecast another 75 bps hike in November before the pace slows to a still accelerated speed of 50 bps in December.[14]

Global Backdrop

There’s still a laundry list of concerns globally, including rising tensions following Russia’s annexation of parts of Ukraine.[15] Recent explosions that caused leaks in the Nord Stream gas pipeline also appeared to have been deliberate acts of sabotage.[16] Across the pond, a controversial plan to cut taxes by the U.K. government sent UK bond markets into a tailspin on fears it could make inflation even worse. Bond markets calmed slightly only after the Bank of England pledged to buy U.K. government bonds “on whatever scale necessary” to bring yields back down.[17]

The act of buying bonds is a quantitative easing measure – a complete reversal of the Bank of England’s original plan to begin selling bond holdings and tightening monetary conditions.[18] It’s also a reminder that financial stability and functioning markets are key mandates of central banks.[19] Overall the US economy is on relatively better footing globally, allowing the Fed to follow through with rate hikes to fight inflation.[20]

The Importance of Price Stability

To continue maintaining financial strength, the Fed has a dual mandate of full employment with price stability. Inflation expectations matter because how we expect prices to rise in the future tends to feed into actual inflation.

September data had rays of hope — the University of Michigan survey’s one-year consumer inflation expectations slipped to a reading of 4.7% in September, which was the lowest since September 2021 and down from August. The survey’s five-year inflation outlook also fell below the 2.9%-3.1% range for the first time since July 2021.[21]

As Loretta Mester, the President and CEO of the Federal Reserve Bank of Cleveland notes, price stability is the foundation of a strong economy and necessary for “ensuring that the US can sustain healthy labor market conditions over the medium and longer run.”[22] As a result, the Fed is resolving to crush inflation even if it comes at a cost to the economy short term.[23]

A Long Term View

Looking ahead, PIMCO’s cyclical outlook sees meaningful economic headwinds, sticky inflation, and, more likely than not, a shallow recession.[24] We expect to see continued volatility, given the uncertainty.

It’s human nature to feel hesitant when recession talk emerges. However, J.P. Morgan Asset Management cautions against excess pessimism. Both equity and bond market valuations have dropped significantly, with high-quality fixed income valuations sitting at 10-year lows and S&P forward multiples, which represent valuation expectations, below long-term averages.[25] Historically a combination of attractive valuations and higher market volatility has led to significant long-term investment opportunities.[26]

Meanwhile, we offer our condolences to the families and lives affected by the devastation wrought by Hurricane Ian. We pray for speedy rebuilding and are thankful for the first responders bravely battling the storm to save lives.

We’ve seen turbulence many times before in our 26 plus years of planning and executing personalized investment strategies. Calamity creates the seeds of opportunity, and we are here to help you navigate through the fear and explore potentially attractive possibilities. As always, please reach out with questions about markets, your portfolios, and planning opportunities. Now is a good time to set up a year-end meeting to review any questions you might have. We hope you enjoy an entertaining and spooky Halloween!

Your Friends at JSF

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of NewEdge Securities, Inc. Neither JSF Financial LLC nor NewEdge Securities, Inc. gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase, sale or holding of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or NewEdge Securities, Inc. as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

The Nasdaq Composite is a market-capitalization-weighted index consisting of all Nasdaq Stock Exchange listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds or debenture securities.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] https://www.reuters.com/markets/us/aggressive-fed-hikes-rates-another-75-bp-surprising-no-one-2022-09-21/

[2] https://www.cnbc.com/2022/08/29/usually-the-worst-month-for-stocks-this-september-could-buck-trends.html

[3] https://www.marketwatch.com/story/its-the-worst-september-for-stocks-since-2008-what-that-means-for-october-11664537946

[4] https://www.washingtonpost.com/business/asian-stocks-sink-on-german-inflation-british-tax-cuts/2022/09/30/314027ee-4080-11ed-8c6e-9386bd7cd826_story.html

[5] https://www.bloomberg.com/opinion/articles/2022-09-23/bond-yields-leave-the-ice-age-as-post-volcker-trend-ends-for-world-economy

[6] https://www.bloomberg.com/news/articles/2022-09-20/wall-street-is-starting-to-believe-in-bonds-again-on-4-yields

[7] https://www.schwab.com/learn/story/does-market-timing-work

[8] https://www.schwab.com/learn/story/market-perspective

[9] https://apnews.com/article/inflation-business-economy-prices-12062bc2f39d2929997475111654c7c6

[10] https://www.cnbc.com/2022/09/20/stock-market-futures-open-to-close-newshtml.html

[11] https://www.blackrock.com/corporate/literature/market-commentary/weekly-investment-commentary-en-us-20220926-sour-fed-growth-view-not-dour-enough.pdf

[12] https://www.blackrock.com/corporate/literature/market-commentary/weekly-investment-commentary-en-us-20220926-sour-fed-growth-view-not-dour-enough.pdf

[13] https://www.blackrock.com/corporate/literature/market-commentary/weekly-investment-commentary-en-us-20220926-sour-fed-growth-view-not-dour-enough.pdf

[14] https://se.pimco.com/en-se/insights/blog/with-aggressive-rate-forecasts-fed-seeks-to-reinforce-commitment-to-taming-inflation

[15] https://www.wsj.com/livecoverage/russia-ukraine-war-news-putin-annexation?mod=hp_lead_pos1

[16] https://www.bloomberg.com/news/articles/2022-09-30/biden-says-nord-stream-leak-was-deliberate-act-of-sabotage

[17] https://www.cnbc.com/2022/09/28/bank-of-england-delays-bond-sales-launches-temporary-purchase-program.html

[18] https://www.nytimes.com/2022/10/04/business/economy/bank-of-england-truss.html

[19] https://www.bloomberg.com/news/articles/2022-09-29/fed-s-bullard-says-markets-have-gotten-the-message-on-rate-hikes#xj4y7vzkg

[20] https://apnews.com/article/inflation-japanese-yen-euro-8c3b111e940faace365c802bb957e2c1

[21] https://www.reuters.com/markets/us/us-consumer-spending-rebounds-august-inflation-picks-up-2022-09-30/

[22] https://www.clevelandfed.org/newsroom-and-events/speeches/sp-20220926-inflation-inflation-expectations-and-monetary-policymaking-strategy.aspx

[23] https://www.nytimes.com/2022/09/21/business/economy/fed-rates-inflation-powell.html

[24] https://www.pimco.com/en-us/insights/economic-and-market-commentary/cyclical-outlook/prevailing-under-pressure

[25] https://am.jpmorgan.com/content/dam/jpm-am-aem/americas/us/en/insights/market-insights/wmr/weekly_market_recap.pdf

[26] https://am.jpmorgan.com/content/dam/jpm-am-aem/americas/us/en/insights/market-insights/wmr/weekly_market_recap.pdf