A Change of Season

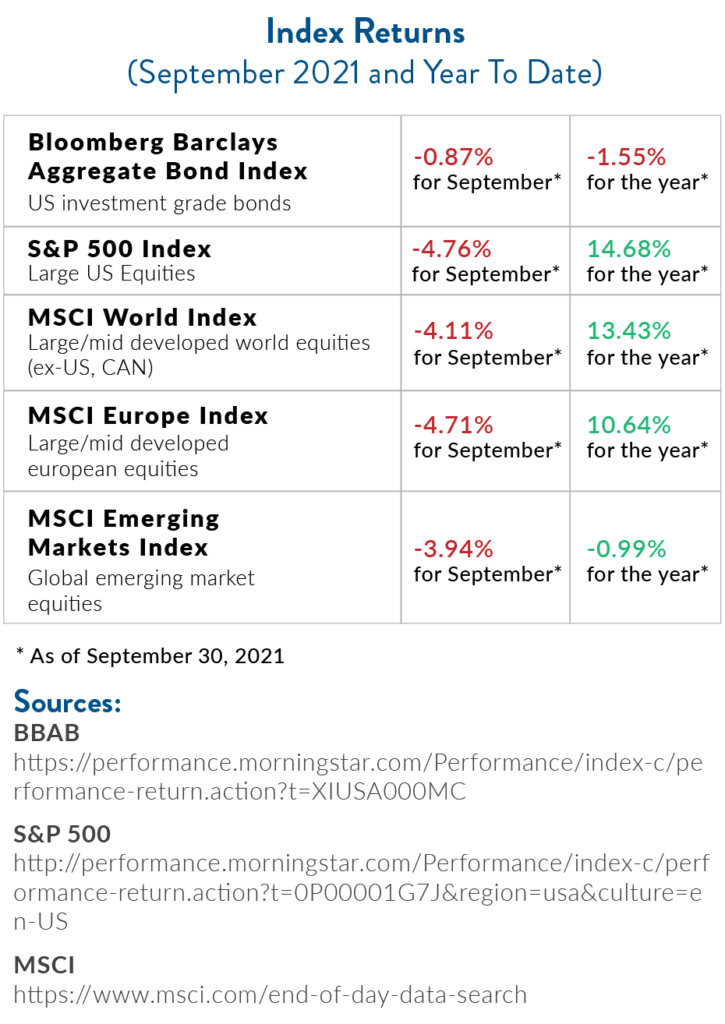

The month of September brought a chill to equity markets, which experienced a 4.76% loss for the month.[1] Following a march of record-setting gains year-to-date, the sell-off was a reminder that markets don’t go up in a straight line, especially with ongoing pressure from COVID-19 variants, political gridlock, and inflation.[2]

The Wind is Blowing in Washington

The Wind is Blowing in Washington

Washington gridlock triggered a few of the rough patches for the month.

The core issue was the August 2019 agreement that brought a two-year suspension of the debt ceiling. If not extended, its expiration could have resulted in a government shutdown and even a default.[3] While this was an unlikely outcome, markets shuddered as negotiations went to the eleventh hour on September 30, when a bill that extended government funding through December 3 was finally signed into law late.[4] Although the bill passed with bipartisan support, the debt ceiling was not addressed, which raises questions about whether this band-aid approach can work again.[5] (As of this writing, the issue remains under debate in Congress.)

Another thorny negotiation revolves around a trillion-dollar Democratic plan to increase infrastructure spending, which would be partially paid for through tax increases.[6]The plan would see top tax brackets for individuals and corporations raised to 39.6% and 26.5% respectively.[7] Along with that, the plan proposes a top capital gains rate of 25%.[8] There would be an additional individual surcharge of 3% on income above $5 million annually.[9]

Another thorny negotiation revolves around a trillion-dollar Democratic plan to increase infrastructure spending, which would be partially paid for through tax increases.[6]The plan would see top tax brackets for individuals and corporations raised to 39.6% and 26.5% respectively.[7] Along with that, the plan proposes a top capital gains rate of 25%.[8] There would be an additional individual surcharge of 3% on income above $5 million annually.[9]

The estate tax exemption, which at the moment is set to fall in 2025 from $11.7 million down to approximately $5 million, would decrease in 2022 instead.[10]

Other proposals touch on retirement account rules—such as eliminating Roth IRA conversions and prohibiting contributions to IRA accounts with more than $10 million. Proposals have also been raised to increase required minimum distributions (RMDs) on IRAs with large balances and to bar investments that require accredited investor status (or in which the account owner has a significant interest).[11]

This is a lot to take in, of course, and considering the contentiousness of the debt ceiling discussion, it’s possible that the bill which finally passes will look very different to the proposals we’re reading about today.

Is Inflation Sticking Around?

Consumer prices have been noticeably higher, from cars to electronics to furniture [12] – if you can find them with continued shipping and manufacturing delays. Until the last week of September, the Federal Reserve indicated that inflation would start falling back towards the 2% target by the end of the year.[13] The idea was that pent-up demand related to the pandemic would be relatively transient; however, Fed Chair Jerome Powell acknowledged that US inflation could last into early next year because of worsening material shortages and supply bottlenecks.[14]

To manage higher inflation, the Fed could be prompted to tighten monetary policy and raise the federal funds rate sooner rather than later. They have already signaled that a hike could be coming as early as 2023.[15]

To manage higher inflation, the Fed could be prompted to tighten monetary policy and raise the federal funds rate sooner rather than later. They have already signaled that a hike could be coming as early as 2023.[15]

We’ll want to keep an eye on the persistence of inflation and of course on Fed policy. While the Fed has been very communicative about its plans for tightening and the conditions under which it will do so, it’s always possible that markets will react sharply to any uncertainty or unexpected news.

Heading Into Year-End

In light of the Delta variant, mask precautions are making a comeback as we head into cold and flu season. The CDC is urging even vaccinated Americans to wear masks indoors once again, which is a departure from previous guidance in May.[16] Clearly, this pandemic isn’t over yet, and the impact on markets could continue to be significant as we navigate this next chapter.

Here at the office, we are still offering in-person client meetings with mask requirements in place; however, we understand if you prefer to keep our communications virtual for now. As we schedule our year-end reviews, remember that we are more than happy to accommodate your preferences. We’re looking forward to speaking with you and mapping out the final quarter of 2021 and the New Year as we face a myriad of potential tax law changes and heightened market volatility.

Here at the office, we are still offering in-person client meetings with mask requirements in place; however, we understand if you prefer to keep our communications virtual for now. As we schedule our year-end reviews, remember that we are more than happy to accommodate your preferences. We’re looking forward to speaking with you and mapping out the final quarter of 2021 and the New Year as we face a myriad of potential tax law changes and heightened market volatility.

In the meantime, we hope you’ve had a great start to the new school year—and to the re-appearance of coveted pumpkin spice latte!

Download print version of this article.

The information expressed herein are those of JSF Financial, LLC, it does not necessarily reflect the views of Mid Atlantic Capital Corporation (MACC). Neither JSF Financial LLC nor MACC gives tax or legal advice. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation or recommendation for the purchase or sale of any security. Investing involves risk, including possible loss of principal. Indexes are unmanaged and cannot be invested in directly.

Historical data shown represents past performance and does not guarantee comparable future results. The information and statistical data contained herein were obtained from sources believed to be reliable but in no way are guaranteed by JSF Financial, LLC or MACC as to accuracy or completeness. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. Diversification does not ensure a profit or guarantee against loss. Carefully consider the investment objectives, risks, charges and expenses of the trades referenced in this material before investing.

Asset Allocation and Diversification do not guarantee a profit or protect against a loss.

The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasury securities, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Europe Index captures large and mid-cap representation across 15 developed markets countries in Europe and covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP is the most commonly used measure of economic activity.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://performance.morningstar.com/Performance/index-c/performance-return.action?t=0P00001G7J®ion=usa&culture=en-US

[2] https://www.marketwatch.com/story/the-s-p-500-hasnt-seen-a-year-to-date-rally-this-strong-since-1997-whats-next-11630358776

[3] https://www.crfb.org/papers/qa-everything-you-should-know-about-debt-ceiling

[4] https://www.wsj.com/articles/congress-set-to-avert-government-shutdown-11633011465

[5] https://www.wsj.com/articles/congress-set-to-avert-government-shutdown-11633011465

[6] https://www.cnbc.com/2021/09/13/house-democrats-propose-tax-increases-in-3point5-trillion-budget-bill.html

[7] https://www.cnbc.com/2021/09/13/house-democrats-propose-tax-increases-in-3point5-trillion-budget-bill.html

[8] https://www.cnbc.com/2021/09/13/house-democrats-propose-tax-increases-in-3point5-trillion-budget-bill.html

[9] https://www.cnbc.com/2021/09/13/house-democrats-propose-tax-increases-in-3point5-trillion-budget-bill.html

[10] https://www.cnbc.com/2021/09/13/house-democrats-propose-hiking-capital-gains-tax-to-28point8percent-.html

[11] https://www.forbes.com/sites/garthfriesen/2021/09/15/democrat-tax-proposals-for-retirement-accounts-will-affect-more-than-the-wealthy/?sh=3fa2f6203395

[12] https://www.businessinsider.com/when-will-prices-go-down-cars-furniture-cheaper-few-months-2021-7

[13] https://www.marketwatch.com/story/u-s-inflation-rises-sharply-again-in-august-and-remains-at-30-year-high-pce-shows-11633092039

[14] https://www.marketwatch.com/story/feds-powell-says-high-u-s-inflation-could-last-into-early-next-year-due-to-shortages-11632938138

[15] https://www.marketwatch.com/story/fed-officials-say-tapering-may-soon-be-warranted-and-pencil-in-an-earlier-rate-hike-11632333636

[16] https://www.nytimes.com/live/2021/07/27/world/covid-delta-variant-vaccine

Performance table sources:

BBAB: https://performance.morningstar.com/Performance/index-c/performance-return.action?t=XIUSA000MC